Chatbots: New Sales Agent in Insurance Industry

As of today, the insurance industry faces a myriad of challenges not often seen in other sectors. With the world becoming more digital by the day, policyholder and consumer expectations change.

They now shop for insurance policies online, compare quotes before speaking to an agent, and even self-service their policies. As consumers now have the ease of quick access to information, the insurance industry will need to look for ways to overhaul its processes to ameliorate the relationship between policyholder and provider.

A study by Accenture shows that 74% of people would be willing to buy insurance from non-insurance companies. Today, an insurance firm’s offering and product aren’t enough to make it stand out. If there is a brand differentiator that mustn’t be overlooked, it’s customer experience.

Generational changes have resulted in new customers who are digitally native and who have high demands when it comes to how a brand treats them. These expectations shouldn’t be taken lightly: one-third of consumers say they would consider switching companies after a single case of poor customer service.

Moreover, Covid-19 has further enhanced the need to provide both proficient customer support to clients who are confined at home and to overcome the challenge of being unable to access employees too.

Meanwhile, consumer and policyholder expectations for 24/7 self-service continues to grow every passing day. They no longer prefer to use web forms and are shifting from phone calls to mobile apps and messaging. Today, digital marketing gives the insurance industry several channels to reach its potential customers.

However, what happens if a customer were to knock the door of an insurance company and return unattended?

If an agent isn’t available to offer relevant information (could be in the form of a quote or even servicing a claim), the potential customer goes on to find another provider.

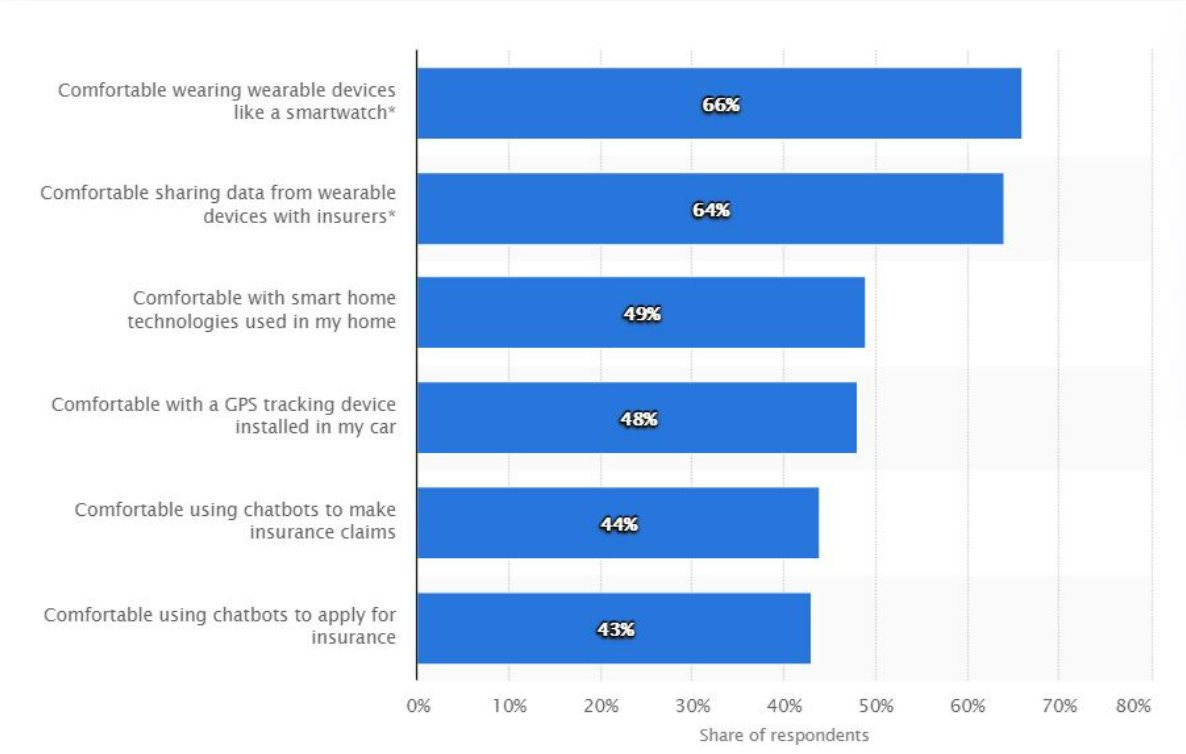

Chatbots can provide faster and cheaper customer service, and accelerate sales and marketing efforts. There are chatbot applications for almost all industries, including healthcare, banking, and insurance. According to a Statista survey in 2019, 44% of customers are comfortable using chatbots to make insurance claims, and 43% are comfortable using them to buy insurance policies. Chatbots can manage claims instantly and deliver customized quotes to simplify insurance-related processes and enhance customer service.

Insurance Chatbot Benefits

According to Moz, 80% of brands are using chatbots for customer interactions today. Here is a list of their most popular benefits:

Efficiency and convenience. These virtual agents provide an easy way for consumers to gather information or ask questions on their own schedule. They don’t have wait a day or two (or longer) for an email response – or stay on hold waiting for the next available customer service representative.

24/7 availability. Most chatbots are available any time of day or night, which means customers can submit a question when most other help lines and agents aren’t available, such as nights, weekends, and holidays. According to Finance Online, 64% of users say the best insurance chatbot feature is the ability to contact customer service 24 hours a day.

Immediate answers. In many cases, when customers have questions, they are looking for answers almost instantly. To prove this point, HubSpot calculated that of the 71% of customers who use messaging apps for customer service, many do so because they want answers quickly – and chatbots may be the answer because of their easy-to-use functionality and availability.

Reallocate employee workload. Insurance chatbots can also free up employees who may otherwise be answering phone calls or replying to emails, which can save time and money. Chatbots can help employees process and manage new claims and handle ordinary tasks such as updating accounts. They can even provide personalized quotes.

Streamline processes. Chatbots can impact and streamline everything from claims to understanding data analysis.

Improve customer relationships. According to HubSpot, the majority of millennials who have interacted with a business’ chatbot say the experience positively impacted their perception of the organization.

Generate leads. When customers interact with a chatbot, they may be expected to fill in basic contact information, such as name and email address. This is a simple, easy way for insurers to generate leads.

Integrate with social media channels. Chatbots can be positioned across channels that consumers use every day. “They accomplish their task, start to finish, in the place where you already spend your time: messaging apps,” according to HubSpot.

Chatbots can also help insurers keep pace with the demands of customer service. Their response is often faster than a human one, and unlike a person, they can handle multiple customer inquiries at once.

Chatbots have answered a need for an alternative form of customer service communication. While some people still prefer calling or emailing with a question, others find that chatbots are less time-consuming and at times more efficient. In general, though, “chatbots are best used in situations where a back-and-forth interaction is required,” according to Forbes.

Use-cases of Chatbots in Insurance Sales

Process claims. Chatbots can assist with claims questions and payment methods.

Gather leads. When customers interact with a chatbot, they may be expected to fill in basic contact information, such as name and email address, which is a simple and effective way to accumulate customer data and generate leads. This information can be passed along to sales teams.

Provide education. In many cases, someone will contact an insurer with questions about a product or process. A chatbot can answer questions and provide more information – or direct those inquiries to the appropriate departments or resources.

Engage with customers and collect feedback: Chatbots are often faster and more efficient than phone calls and emails. Plus, they offer a way for an insurer to easily compile data on their various customer service inquiries.

Free up employees. Employees can tackle other important responsibilities if chatbots help handle customer service inquiries.

Road Ahead:

According to a 2020 survey, the COVID-19 pandemic 50% of consumers to question their medical and life insurance policies, and 75% said that they’d prefer having a conversation before making a purchase of an insurance policy.

Additionally, ±75% said that they trusted chatbots to provide a new or a renewal quote, make a claim, add a member to coverage, and update billing info.

In addition to customers’ increasing acceptance of chatbots in the insurance industry, insurance companies’ spending on cognitive/artificial intelligence software is estimated to reach $571M in 2021 rising from $76M in 2016. Therefore, we expect to see more implementation opportunities of chatbots in the insurance industry.

If you’d like to develop a chatbot for insurance, drop us a note on contact@artivatic.ai with us.

We’d be happy to chat, learn more about your use case and build an interactive chatbot that can assist you in increasing conversion and customer retention with the power of conversational AI.

Sources for Stats: