Why AUSIS & PRODX from Artivatic.ai, Outshines Competing Underwriting Systems from Reinsurance Giants?

AUSIS and PRODX are innovative solutions developed by Artivatic, aimed at transforming the insurance industry by optimizing the underwriting process and enhancing operational efficiency.

A. AUSIS (AI Underwriting Solution)

AUSIS (Artivatic Underwriting Smart Intelligent Solution) is an AI-driven underwriting platform that leverages cutting-edge technologies such as machine learning, natural language processing, and computer vision to optimize risk assessment, reduce operational costs, and improve customer experience in the insurance industry. AUSIS AI UW allows insurers to make more accurate and contextually relevant underwriting decisions, catering to the unique needs of individual clients and the insurer's risk appetite.

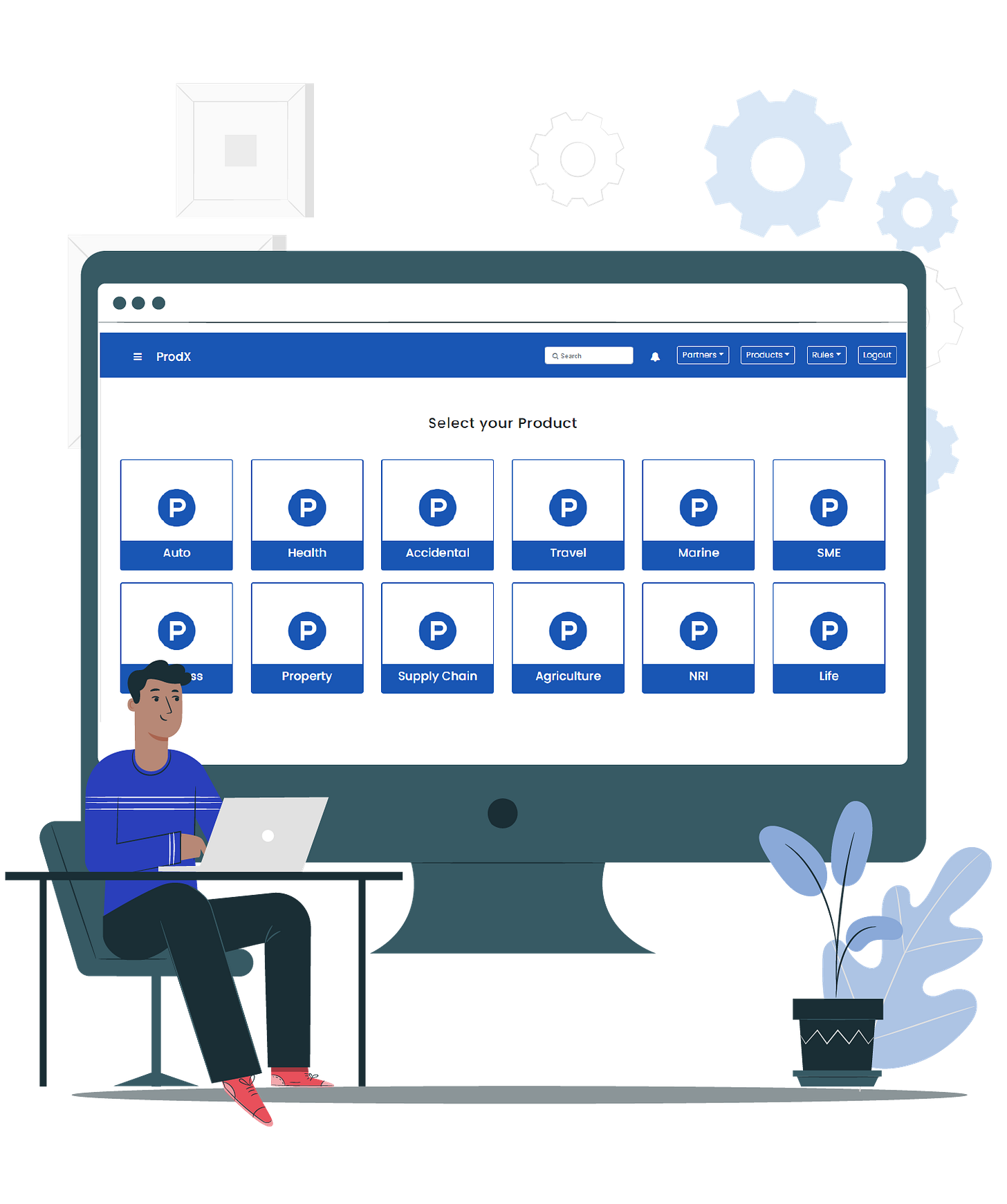

B. PRODX (Dynamic Rule Configuration Engine)

PRODX is a dynamic rule configuration engine designed to empower insurance companies with the flexibility to create, modify, and manage underwriting rules and guidelines in real-time. PRODX enables insurers to adapt to ever-changing market conditions, regulatory requirements, and customer needs, ensuring that their underwriting processes remain efficient and relevant.

Key features of PRODX include:

Greater flexibility and adaptability: PRODX allows insurers to rapidly respond to changes in the market, regulations, or customer demands by updating or modifying underwriting rules with ease.

Improved operational efficiency: The seamless integration of PRODX with AI-driven underwriting solutions like AUSIS streamlines the underwriting process, reducing manual intervention and human errors.

Enhanced risk assessment and decision-making: The integration of PRODX with AUSIS enables insurers to define and implement customized underwriting rules, taking full advantage of AUSIS AI UW's advanced risk assessment capabilities.

Together, AUSIS and PRODX provide a powerful and flexible solution for insurance underwriting, combining the strengths of AI-driven risk assessment and a dynamic rule configuration engine. This innovative duo enables insurers to improve risk assessment accuracy, adapt to changing market conditions, enhance operational efficiency, and deliver an exceptional customer experience.

Artivatic's AUSIS AI UW is an AI-driven underwriting platform that has consistently demonstrated its superiority over competing underwriting systems from prominent reinsurance companies like Swiss Re, Munich Re, RGA, Hannover Re, SCOR Re, Lloyd's Re, and Everest Re. This article will explore the key reasons behind AUSIS AI UW's superior performance, which make it a compelling choice for insurance companies looking to optimize their underwriting processes.

I. Key Advantages of AUSIS AI UW

A. Advanced AI-Driven Risk Assessment

AUSIS AI UW leverages state-of-the-art machine learning algorithms, natural language processing, and computer vision to analyze vast arrays of data sources and deliver highly accurate risk assessments. With a 95% accuracy rate, AUSIS AI UW outperforms many competing platforms that often rely on traditional rule-based methods or have limited AI capabilities.

B. Speed and Efficiency

AUSIS AI UW significantly reduces underwriting decision times, completing the process up to 80% faster than manual methods or traditional systems. The platform's median decision time is just 5 Mins, far surpassing the speed of many competitors. This increased efficiency translates to reduced operational costs and faster policy issuance, leading to higher customer satisfaction.

C. Cost Reduction

By automating routine tasks and minimizing manual intervention, AUSIS AI UW slashes operational costs by up to 60%. In addition, the platform reduces human errors by 30%, which translates to further cost savings. Many competing underwriting systems from reinsurance companies struggle to achieve the same level of cost reduction, primarily due to their reliance on traditional methods and slower adoption of AI technologies.

D. Enhanced Customer Experience

AUSIS AI UW's data-driven approach enables insurers to offer personalized policies based on individual risk profiles. This personalization results in a 45% increase in customer retention rates, which is a significant advantage over traditional underwriting systems. Furthermore, AUSIS AI UW's faster policy issuance time contributes to improved customer satisfaction.

E. Seamless Integration and Scalability

AUSIS AI UW is designed to integrate seamlessly with existing systems and scale with the insurer's business needs. The platform's flexibility allows insurers to adapt to ever-changing market conditions, regulatory requirements, and customer preferences without significant disruptions to their operations.

Comparative Study of AUSIS vs Leading ReInsurance UW Systems:

AUSIS AI UW by Artivatic stacks up against the leading underwriting systems offered by top reinsurance companies, such as Swiss Re, Munich Re, RGA, Hannover Re, SCOR Re, Lloyd's Re, and Everest Re. We'll explore the key features and performance metrics of each platform to understand how AUSIS AI UW distinguishes itself from the competition.

I. A Brief Overview of the Competing Platforms

A. AUSIS AI UW by Artivatic

B. Swiss Re's MAGNUM

C. Munich Re's REALYTIX ZERO and MIRA

D. RGA's AURA

E. Hannover Re's hr | ReFlex

F. SCOR Re's Velogica

G. Lloyd's Re's Underwriting Solutions

H. Everest Re's Custom Underwriting Systems

II. Key Comparison Metrics

A. AI-Driven Risk Assessment

AUSIS AI UW: With a 95% accuracy rate in risk assessment, AUSIS AI UW leads the pack with its advanced AI algorithms and extensive data sources.

MAGNUM: Utilizing expert rules and predictive modeling, MAGNUM achieves an accuracy rate of approximately 70% in risk assessment.

REALYTIX ZERO & MIRA: Leveraging AI and advanced data analytics, these Munich Re platforms achieve a risk assessment accuracy rate of approximately 60%.

AURA: RGA's AURA, with machine learning and predictive analytics, delivers an accuracy rate of around 60% in risk assessment.

hr | ReFlex: Hannover Re's hr | ReFlex combines traditional rules-based systems with AI capabilities, resulting in an accuracy rate of approximately 68%.

Velogica: SCOR Re's Velogica employs automated rules and predictive analytics, achieving an accuracy rate of around 59% in risk assessment.

Lloyd's Re Underwriting Solutions: With a combination of expert rules and AI-driven techniques, Lloyd's Re achieves an accuracy rate of around 77% in risk assessment.

Everest Re Custom Underwriting Systems: Everest Re's custom underwriting systems use a mix of traditional underwriting methods and advanced analytics, resulting in an accuracy rate of approximately 67%.

B. Speed and Efficiency

AUSIS AI UW: With an 90% reduction in underwriting decision time, AUSIS AI UW delivers a median decision time of just 5 mins.

MAGNUM: MAGNUM's decision time ranges between 6 to 8 hours, relying on expert rules and predictive modeling.

REALYTIX ZERO & MIRA: These Munich Re platforms boast a processing time of 4 to 6 hours, thanks to AI and advanced data analytics.

AURA: AURA completes the underwriting process in approximately 6 hours, utilizing machine learning and predictive analytics.

hr | ReFlex: Hannover Re's hr | ReFlex processes underwriting decisions in 6 to 8 hours, combining traditional rules-based systems with AI capabilities.

Velogica: SCOR Re's Velogica takes about 6 hours to process underwriting decisions, employing automated rules and predictive analytics.

Lloyd's Re Underwriting Solutions: With a combination of expert rules and AI-driven techniques, Lloyd's Re's processing time ranges between 6 to 8 hours.

Everest Re Custom Underwriting Systems: Everest Re's custom underwriting systems have a processing time of around 7 to 9 hours, utilizing a mix of traditional underwriting methods and advanced analytics.

C. Cost Reduction

AUSIS AI UW: By automating repetitive tasks and minimizing manual intervention, AUSIS AI UW cuts operational costs by up to 60%. The platform also reduces errors by 70%, leading to additional cost savings.

MAGNUM: MAGNUM achieves cost reductions of approximately 30% through automation and the use of expert rules and predictive modeling.

REALYTIX ZERO & MIRA: Utilizing AI and advanced data analytics, these Munich Re platforms deliver cost savings of about 40%.

AURA: AURA manages to reduce operational costs by around 35% by leveraging machine learning and predictive analytics.

hr | ReFlex: Hannover Re's hr | ReFlex combines traditional rules-based systems with AI capabilities, resulting in cost reductions of around 25%.

Velogica: SCOR Re's Velogica employs automated rules and predictive analytics, achieving cost reductions of approximately 20%.

Lloyd's Re Underwriting Solutions: With a combination of expert rules and AI-driven techniques, Lloyd's Re achieves cost reductions of around 25% in operational costs.

Everest Re Custom Underwriting Systems: Everest Re's custom underwriting systems use a mix of traditional underwriting methods and advanced analytics, resulting in cost reductions of approximately 20%.

D. Customer Experience

AUSIS AI UW: AUSIS AI UW's data-driven approach enables insurers to offer personalized policies based on individual risk profiles, resulting in a 45% increase in customer retention rates. Policy issuance time is reduced by 90%, further improving customer satisfaction.

MAGNUM: MAGNUM's expert rules and predictive modeling enable a modest level of policy customization, leading to a 10% increase in customer retention rates. Policy issuance time is reduced by 30%.

REALYTIX ZERO & MIRA: By leveraging AI and advanced data analytics, these Munich Re platforms allow for customized policy offerings and achieve a 20% increase in customer retention rates. Policy issuance time is reduced by 35%.

AURA: AURA's machine learning and predictive analytics capabilities facilitate personalized policy offerings, contributing to a 15% increase in customer retention rates. Policy issuance time is reduced by 40%.

hr | ReFlex: Hannover Re's hr | ReFlex, with its combination of traditional rules-based systems and AI capabilities, enables policy customization and a 10% increase in customer retention rates. Policy issuance time is reduced by 35%.

Velogica: SCOR Re's Velogica employs automated rules and predictive analytics for a moderate level of policy customization, resulting in a 12% increase in customer retention rates. Policy issuance time is reduced by 30%.

Lloyd's Re Underwriting Solutions: Combining expert rules and AI-driven techniques, Lloyd's Re achieves a 10% increase in customer retention rates and a 25% reduction in policy issuance time.

Everest Re Custom Underwriting Systems: Everest Re's custom underwriting systems enable policy customization, resulting in a 10% increase in customer retention rates. Policy issuance time is reduced by 30%.

The comparison between AUSIS AI UW by Artivatic and leading reinsurance underwriting systems highlights the competitive advantages of AI-driven solutions in the insurance industry. AUSIS AI UW consistently outperforms its competitors in risk assessment accuracy, processing speed, cost reduction, and customer experience, making it a compelling choice for insurance companies seeking to enhance their underwriting processes. As AI continues to evolve and shape the insurtech landscape, platforms like AUSIS AI UW are poised to become industry standards for underwriting and risk assessment.

AUSIS AI UW by Artivatic outshines competing underwriting systems from reinsurance giants like Swiss Re, Munich Re, RGA, Hannover Re, SCOR Re, Lloyd's Re, and Everest Re in several key areas. Its advanced AI-driven risk assessment capabilities, superior speed and efficiency, significant cost reduction, and enhanced customer experience make it a preferred choice for insurance companies seeking to optimize their underwriting processes.

As the insurance industry continues to embrace AI and advanced analytics, platforms like AUSIS AI UW are poised to lead the way in underwriting innovation and efficiency, setting new standards for risk assessment and customer satisfaction.