Transforming Life and Health Insurance: The Revolutionary Impact of AI and GenAI

The integration of AI and GenAI in life and health insurance is transforming the industry, offering personalized products, enhanced risk assessment, and streamlined operations.

The insurance industry, particularly in the life and health sectors, is undergoing a profound transformation, thanks to the advancements in Artificial Intelligence (AI) and Generation AI (GenAI). These technologies are not just enhancing existing processes; they're redefining the way insurers operate, interact with customers, and manage risks. This article explores the numerous ways AI and GenAI are revolutionizing the insurance landscape.

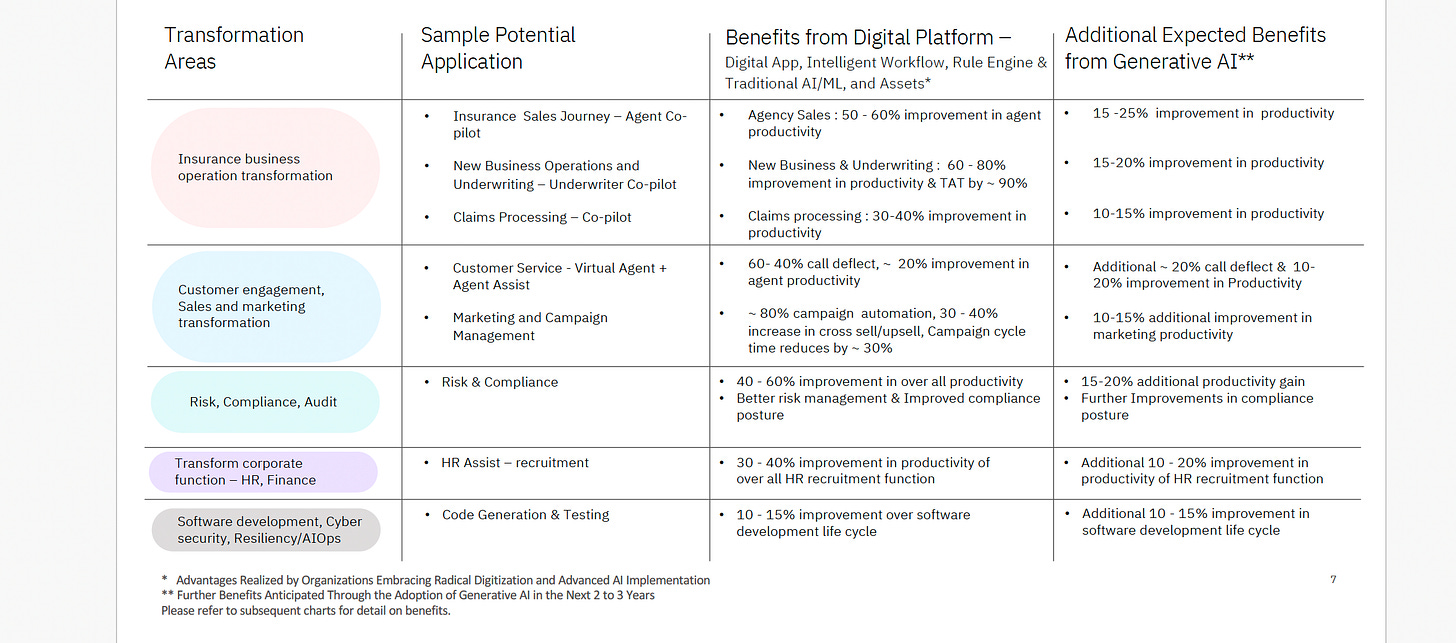

Some of the use cases for transforming health and life insurance with AI/GenAI:

Personalized Products and Services

Tailored Insurance Products

AI algorithms are now capable of analyzing extensive personal data, including health records and lifestyle choices, to design insurance products that meet individual needs. This leads to more accurate coverage, personalized pricing, and improved customer satisfaction.

Dynamic Rule Configurations

AI systems adapt seamlessly to changing insurance regulations, ensuring products and processes remain compliant. This agility is critical in a sector where regulatory landscapes are constantly evolving.

Enhanced Decision-Making and Risk Assessment

AI-Enabled Risk Scoring & Underwriting

With AI, insurers can assess risks more accurately by considering a broader range of factors, leading to more informed underwriting decisions. This approach translates into more accurate premium settings and better identification of high-risk individuals.

Predictive Analytics

AI's predictive analytics capabilities enable insurers to forecast future health events, facilitating early interventions and better health management, potentially reducing claim costs.

Automated Policy Management

From issuance to renewals, AI automates many aspects of policy management, enhancing efficiency and reducing human error.

Streamlining Claims Operations

Pre-Auth Approval and Validation

AI streamlines the pre-authorization process in health insurance, making it faster and more efficient. It can quickly validate the necessity of medical procedures against policy details.

Claims Processing

AI significantly expedites claims processing by automating tasks like data entry and decision-making. This automation not only speeds up claim settlements but also enhances accuracy and customer satisfaction.

Fraud Detection

AI algorithms are adept at detecting patterns and anomalies indicative of fraudulent activities, helping insurers save significantly by preventing false claims.

Sales, Quote, Customer Engagement and Support

Intelligent Sales and Quote Processes

AI improves customer interactions by providing personalized quotes and recommendations, ensuring that customers receive the best possible coverage for

Inbuilt Communications

AI-driven chatbots and virtual assistants provide 24/7 customer service, answering queries, and offering support throughout the insurance lifecycle.their needs.

Employer / Corporate /Broker Platforms

AI assists brokers /Corporates in managing client /employee portfolios, offering personalized advice, and staying updated with the latest market trends and products.

24/7 Customer Service

AI-driven chatbots and virtual assistants offer round-the-clock customer support, answering queries and providing assistance throughout the insurance lifecycle.

Enhanced Collaboration with Healthcare Providers

AI enables better coordination between insurers and healthcare providers, leading to improved care management and cost efficiency.

Smart AI Enabled Portals, Automation & Workflows

System-Driven Automations

Automated workflows and processes reduce manual tasks, increase efficiency, and lower operational costs.

Smart Workflows

AI optimizes workflow management, ensuring that tasks are completed in the most efficient manner.

Patient/Member Health Apps

These apps use AI to track health metrics and provide insights, encouraging healthier lifestyles and potentially lowering insurance costs.

Hospital Platforms

AI in hospital platforms can streamline patient data management, improve treatment plans, and interface seamlessly with insurance providers.

Intuitive Customer Portals

Enhanced by AI, these portals offer personalized experiences, easy access to policy information, and instant service.

Technological Integration and Innovation

Integration with IoT Devices

Data from Internet of Things (IoT) devices, such as fitness trackers, feed into AI systems, allowing real-time health and risk monitoring, and contributing to proactive health management.

Augmented Reality and Voice/Facial Recognition

AR is used for complex claim assessments and risk evaluations, while voice and facial recognition technologies provide secure and personalized customer experiences.

Leveraging AI for Better Health Outcomes

Insurers are increasingly using AI-driven health apps and wellness programs to encourage healthier lifestyles. These initiatives not only improve individual health outcomes but also have the potential to reduce overall healthcare costs, benefiting both policyholders and insurance providers.

Future Outlook: AI in Insurance

The Role of AI in Global Market Strategies

AI's ability to analyze global market trends provides insurers with invaluable insights for expansion and diversification strategies. This global perspective is essential for insurers aiming to stay competitive in an increasingly interconnected world.

AI's Role in Environmental and Social Governance

With growing concern for environmental and social issues, AI helps in assessing and managing environmental and social governance (ESG) risks. This capability is particularly appealing to customers who prefer engaging with socially responsible companies.

Continuous Learning and Adaptation

AI systems, through machine learning and continuous data analysis, are always learning and adapting. This characteristic ensures that insurance products, services, and operations evolve in line with changing customer needs and market dynamics.

Conclusion: A Transformative Journey Ahead

The journey of integrating AI and GenAI into the life and health insurance sectors is transformative and ongoing. As these technologies continue to evolve, they promise even greater efficiencies, more personalized services, and innovative products. However, this journey also comes with challenges, particularly regarding data privacy, ethical AI use, and regulatory compliance. Insurers who successfully navigate these challenges while leveraging AI's full potential will not only thrive in the current market but will also shape the future of the insurance industry. The integration of AI and GenAI in insurance is not just about keeping pace with technological advancements; it's about leading a transformative journey towards a more efficient, customer-focused, and innovative future.

The integration of AI and GenAI in the life and health insurance sectors is more than a technological upgrade; it's a paradigm shift. These technologies are enabling insurers to create innovative, efficient, and customer-centric products and services. As AI and GenAI continue to evolve, we can expect even more profound changes in the insurance industry, ultimately leading to a more responsive, personalized, and efficient insurance ecosystem.