The Untapped Potential of APIs in the Insurance Sector

Digital transformation has changed the entire world. To stay competitive in this new business and economic environment, leaders of different sectors have realized the importance of using open application programming (APIs) to expand the reach of their organizations.

Various industries have gained from modern API integrated platforms, administered by the growth of new internet technologies like cloud applications and mobile phones. Similarly, the insurance industry has also leveraged advanced digital and data technologies for connectivity and seamless flow of data/information through the entire business value chain.

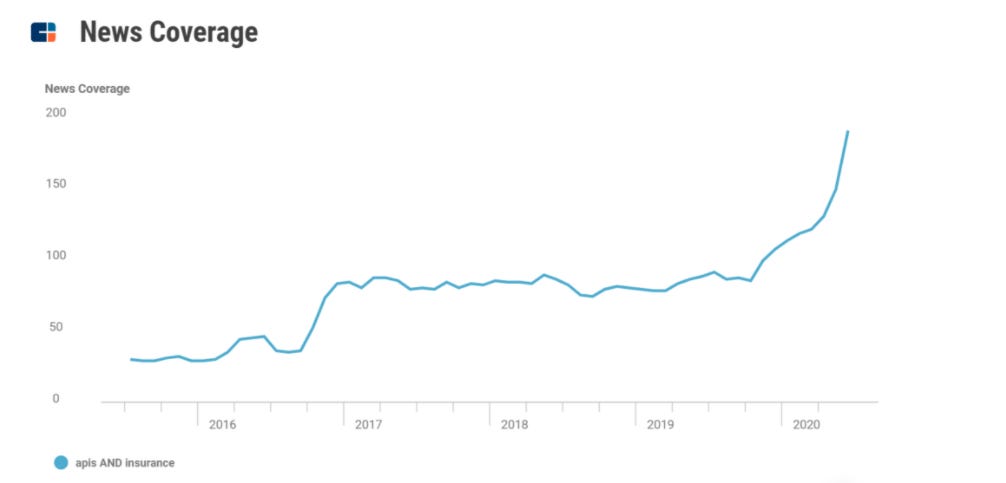

The insurance sector has long been plagued by manual computing, legacy systems, and complicated workflows. However, in the digital transformation era, where customers prefer digital transactions and demand better communications, most insurance industries have started embracing advanced technologies and investing in digital applications for business growth. Multiple insurance sectors have taken steps to use (APIs) in their systems. Moreover, increased interest in APIs and insurance suggests that technology advancement is becoming important in the evolution of digital business models and operating systems.

Source: CBINSIGHTS

Internal APIs for backend communications have been proven beneficial for a while. The focus area is now upon launching APIs to the outside world to offer better services and solutions to policyholders. The approach is to share data that drives value. Insurers are digging into the power of API platforms to create innovation and meet the demand for digital experiences. Some of the benefits of APIs in insurance are:

It allows insurers to build connectivity and facilitate interactions among applications and devices by providing a convenient way to access data- on the cloud or in-house from any app or device.

The connectivity helps the insurance sector turn repetitive and complex processes into reusable ones that drive productivity.

It provides real-time access to policy and account information and payment history.

An established API platform helps in preventing frauds that come in any shape and size.

It also helps in the growth of the partner channel.

In a nutshell, the modern vision of insurance relies on API-led connectivity. For insurers looking to sustain the speed, and upgraded digital efficiency is necessary for advancing the customer experience-API integrations are the must.

To enhance the same and change the way the insurance industry operates, Artivatic has launched an AI Insurance Cloud APIs Platform, called ‘INFRD’.

The BETA version of INFRD Insurance APIs Cloud Platform has 500+ APIs that helps in onboarding, claims, risk management, fraud detection, automated underwriting, KYC, sales and services, marketing, health analysis, health scoring, handwritten documents, micro insurance, claim denials, video-based underwriting, image recognition, patient advisory and many more.

See for yourself what sets Artivatic’s APIs platform apart. SIGN UP HERE.

Need a demo of INFRD, write to apisupport@artivatic.ai