The Transformative Impact of GenAI and AI on the Health Insurance Sector in India and the Middle East

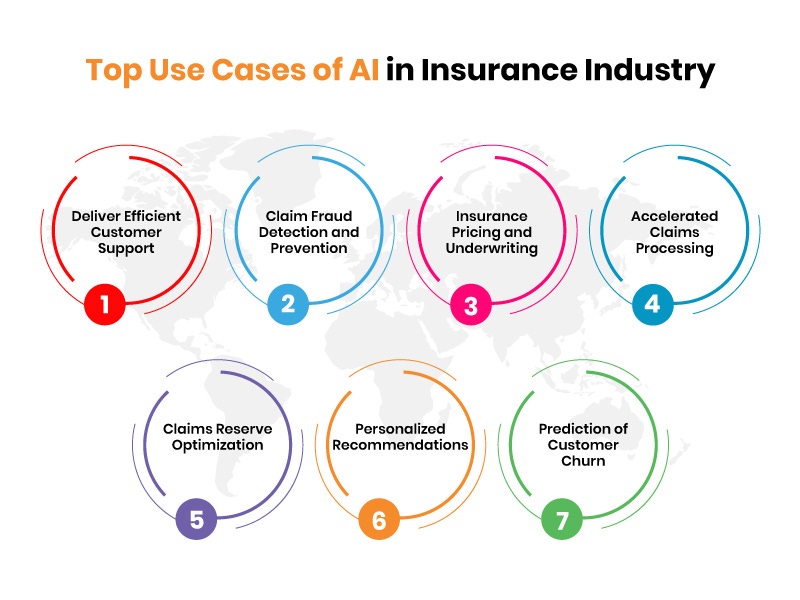

GenAI & AI are revolutionizing the health insurance sector in India and the Middle East by enhancing risk assessment, personalizing policy pricing, improving customer service, and streamlining claims.

The advent of Generation AI (GenAI) and Artificial Intelligence (AI) is revolutionizing numerous industries worldwide, and the health insurance sector in regions like India and the Middle East is no exception. These technological advancements promise to reshape the landscape of health insurance, offering more efficient, personalized, and cost-effective solutions.

The integration of GenAI and AI in the health insurance sector is not just a futuristic idea but a present reality that's reshaping the landscape in regions like India and the Middle East. This extended analysis delves deeper, providing insights, trends, data, and growth projections, highlighting the future focus of AI in transforming health insurance in these regions.

1. Enhanced Data Analysis and Risk Assessment

AI algorithms excel in processing vast amounts of data, a capability that is invaluable in the health insurance industry. In India and the Middle East, where diverse populations present a wide array of health risks and medical histories, AI can analyze these data points to provide more accurate risk assessments. This improved precision in risk assessment allows insurers to offer more tailored policies, benefiting both the provider and the insured. AI-powered tools like chatbots are expected to handle up to 85% of customer service interactions by 2025, as per Gartner. In regions like the Middle East, where digital adoption is high, this could significantly enhance customer experience and operational efficiency.

2. Personalized Policy Pricing

One of the most significant impacts of AI in health insurance is the potential for personalized policy pricing. AI's ability to analyze individual health records, lifestyle choices, and even genetic information can lead to more accurately priced policies. This individualized approach can make health insurance more accessible and affordable for people in India and the Middle East, regions with vast economic disparities.

3. Fraud Detection and Prevention

Fraudulent claims are a major challenge in the health insurance sector. AI algorithms can detect anomalies and patterns that may indicate fraudulent activity. This ability is especially crucial in regions like India and the Middle East, where the high volume of transactions and diverse practices can make fraud detection challenging. By reducing fraud, AI can help in lowering overall costs, which can be passed on to customers in the form of lower premiums. In India, insurance fraud accounts for nearly 8.5% of total claims as per the Economic Times. AI's potential in reducing this figure is significant. AI can enhance fraud detection accuracy by up to 75%, as per a report by Accenture.

4. Improved Customer Service through Chatbots and Virtual Assistants

AI-driven chatbots and virtual assistants are transforming customer service in health insurance. These tools can provide 24/7 support, answering queries, offering policy recommendations, and even guiding customers through the claim process. This technology is particularly beneficial in India and the Middle East, where the demand for health insurance is growing rapidly, and there is a need for efficient customer service solutions.

5. Predictive Analytics for Better Health Outcomes

Predictive analytics powered by AI can forecast potential health issues in individuals before they become serious. This foresight allows for preventative measures, which is not only beneficial for the insured but also reduces the cost burden on insurance companies. In countries like India and the Middle East, where certain health issues are prevalent, this can lead to better health outcomes and more sustainable insurance models. AI's role in predictive healthcare is vital. For example, AI can predict the likelihood of diabetes in the Middle East, where the prevalence is high, thus enabling early intervention. This predictive capability can reduce hospitalization rates by up to 20%, according to a study by Health Affairs.

6. Streamlining Claims Processing

AI can automate and streamline the claims processing, making it faster and more efficient. This automation reduces human error and speeds up the reimbursement process, which is a major concern for policyholders. In regions with growing health insurance markets like India and the Middle East, such efficiency is crucial for customer satisfaction and retention. Automation in claims processing can reduce processing time by up to 40%, as reported by McKinsey. This efficiency is crucial in India, where the health insurance sector is characterized by a high volume of transactions.

7. Challenges and Ethical Considerations

While the benefits of AI in health insurance are significant, there are challenges and ethical considerations, such as data privacy and security, especially in regions with varying regulations like India and the Middle East. Ensuring the ethical use of AI and protecting consumer data must be a top priority for insurers adopting these technologies.

Market Growth and AI Adoption Trends

The health insurance market in India and the Middle East has shown robust growth in recent years. According to a report by the Indian Brand Equity Foundation (IBEF), the Indian health insurance market is projected to reach USD 13 billion by 2025. Similarly, the Middle East's health insurance market is forecasted to grow significantly, driven by regulatory mandates and increasing awareness about health insurance.

AI adoption in these markets is rising in tandem with this growth. A survey by Deloitte indicated that 60% of healthcare executives globally plan to invest heavily in AI within the next two years, with India and the Middle East being key players.

Data Analysis and Risk Assessment

AI's capability in handling big data is revolutionizing risk assessment in health insurance. For instance, predictive analytics can reduce the risk margin error by up to 15%, according to a PwC report. This accuracy is crucial in countries like India, where diverse demographics and health profiles present complex risk assessment challenges.

Customized Policy Pricing

The potential for AI to offer personalized policy pricing is immense. A study by McKinsey suggests that AI can enhance underwriting margins by 3-5% through personalized premiums. This customization is particularly relevant in the Middle East, where expatriates and locals exhibit different health risks and needs.

Future Focus: AI Ethics and Data Security

While AI promises efficiency and personalized services, the future focus will also be on addressing ethical concerns and data security. With different regulatory landscapes in India and the Middle East, developing a standardized framework for AI ethics and data security will be a critical focus area.

Forward Looking

The integration of GenAI and AI into the health insurance sector holds immense promise for transforming the industry in India and the Middle East. From personalized policies and improved risk assessment to enhanced customer service and fraud detection, AI can lead to more efficient, cost-effective, and user-friendly health insurance services. However, balancing these advancements with ethical considerations and data security will be key to realizing the full potential of AI in this sector. The transformative impact of GenAI and AI on the health insurance sector in India and the Middle East is multifaceted. From personalized policy pricing and enhanced risk assessment to improved customer service and fraud detection, AI is setting the stage for a more efficient, cost-effective, and user-centric health insurance ecosystem. The future will likely see a greater emphasis on AI ethics and data security, ensuring that the benefits of AI are harnessed responsibly and inclusively. With the right balance of innovation and regulation, AI has the potential to significantly improve the health insurance landscape in these diverse and rapidly evolving markets