The High Cost of Healthcare in India: A Close Look at Out-of-Pocket Expenses

Nearly 62% Indians pay their medical expenses by themselves that results in financial trouble and impacts long term in accessing education thus impacting on growth, economy.

Indians Paying for healthcare expenses in India

In India, healthcare expenses are often shouldered by individuals and their families due to a lack of universal healthcare coverage and inadequate insurance penetration.

Here are some of the ways Indians pay for healthcare expenses:

Out-of-pocket expenses: A significant portion of healthcare costs in India, around 62%, is borne out-of-pocket by individuals. This means that people pay for medical treatments, consultations, and medications directly, without any financial assistance from insurance or government schemes.

Health insurance: Some Indians have health insurance, either provided by their employers, purchased privately, or obtained through government-sponsored programs. Health insurance can help cover medical expenses, reducing the burden of out-of-pocket payments. However, insurance coverage in India is limited, with only around 29% of urban and 17% of rural households having at least one member with health insurance, according to the National Sample Survey Office (NSSO).

Government schemes and programs: The Indian government has introduced several healthcare schemes, such as the Pradhan Mantri Jan Arogya Yojana (PMJAY), or Ayushman Bharat, to provide financial assistance for healthcare to economically vulnerable families. These programs aim to reduce out-of-pocket expenses for beneficiaries, although their reach and impact are still limited.

Borrowing money: Many Indian families resort to borrowing money from friends, relatives, or moneylenders to cover healthcare costs. This can lead to high-interest loans and long-term debt, exacerbating financial stress for households.

Selling assets: In dire circumstances, some families in India may choose to sell assets such as land, property, or jewelry to cover medical expenses. These distress sales can have long-lasting effects on a family's financial stability and social standing.

Community and crowdfunding support: In some cases, communities or social networks may come together to help individuals and families pay for healthcare expenses through donations or crowdfunding campaigns. This support can be a lifeline for those who cannot afford treatment on their own.

‘Out of pocket’ healthcare expenses in India.

India's healthcare system has long been grappling with multiple challenges, including inadequate infrastructure, a shortage of medical professionals, and insufficient funding. However, one of the most pressing issues faced by millions of Indians is the high out-of-pocket expenses for healthcare.

This article delves into the facts and figures associated with this financial burden and its impact on Indian families.

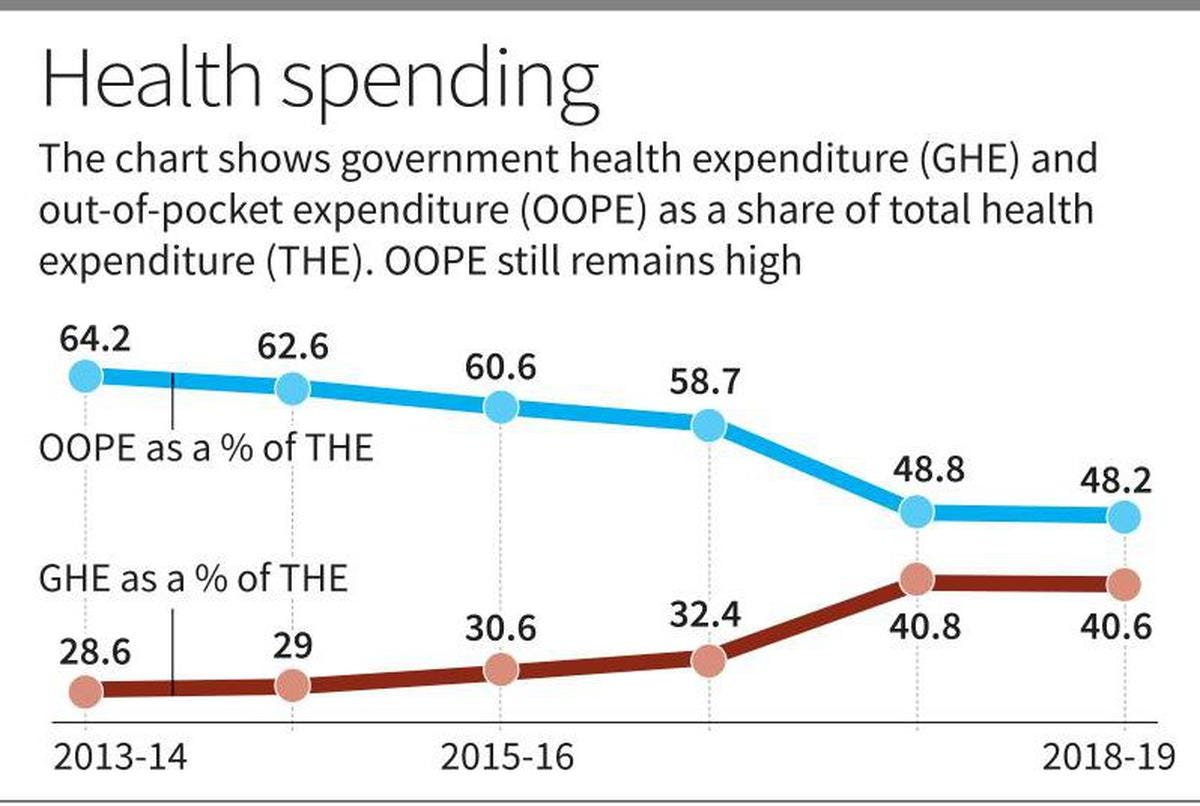

Out-of-Pocket Expenditure in India: According to a report by the World Health Organization (WHO), around 62% of healthcare expenses in India are borne out-of-pocket by individuals, as opposed to being covered by insurance or government schemes. This is significantly higher than the global average of 18.2% and places India among the countries with the highest out-of-pocket healthcare costs.

Impact on Household Finances: A study by the Public Health Foundation of India (PHFI) found that medical expenses push approximately 63 million Indians below the poverty line every year. Around 17% of Indian households are forced to borrow money to cover healthcare costs, with 24% resorting to distress sales of assets.

Lack of Health Insurance Coverage: The National Sample Survey Office (NSSO) reported that only 29% of urban and 17% of rural Indian households have at least one member covered by health insurance. This lack of insurance coverage leaves millions of Indians vulnerable to high out-of-pocket expenses when seeking medical care.

Catastrophic Health Expenditure (CHE): Catastrophic Health Expenditure (CHE) occurs when a household's out-of-pocket medical expenses exceed a certain percentage of its total income, typically 10% or 25%. According to the World Bank, around 32.5% of households in India faced CHE in 2019, causing significant financial strain and pushing many families into poverty.

High Private Healthcare Costs: A study by the Lancet Global Health revealed that the average cost of inpatient care in private hospitals was around four times higher than that of public hospitals. As a result, many patients opt for private healthcare, which leads to increased out-of-pocket expenses.

Impact on Preventive Healthcare: High out-of-pocket expenses discourage individuals from seeking preventive healthcare, which can lead to the progression of diseases and a greater financial burden in the long run. According to a study published in the International Journal for Equity in Health, only 29.9% of Indian households had at least one member who received preventive healthcare.

Gender Disparities in Healthcare Spending: A study conducted by the International Institute for Population Sciences (IIPS) found that out-of-pocket healthcare expenditure for women was 14% less than for men, reflecting gender disparities in healthcare utilization and access.

Regional Differences in Out-of-Pocket Expenditures: Out-of-pocket healthcare spending varies significantly across states in India. According to the National Health Accounts (NHA) 2017-18, the states with the highest out-of-pocket expenditures were Nagaland (80.9%), Bihar (76.9%), and Uttar Pradesh (75.7%), while those with the lowest were Himachal Pradesh (32.6%), Kerala (36.8%), and Punjab (37.3%).

Impact on Indian Families due to ‘Out of Pocket Expenses’ in Healthcare

Not having health insurance in India can significantly impact families, leading to financial, emotional, and social consequences. The lack of insurance coverage exposes families to several risks and challenges, such as:

High out-of-pocket expenses: Without health insurance, families must bear the full brunt of medical expenses, resulting in high out-of-pocket costs. This financial burden can be particularly hard to manage for low-income families or those dealing with chronic illnesses or catastrophic health events.

Debt and financial stress: Families without health insurance often resort to borrowing money from friends, relatives, or moneylenders to cover medical costs. This can lead to high-interest loans, long-term debt, and financial stress, which may affect the overall well-being of the family.

Distress sales of assets: In some cases, families may be forced to sell assets, such as land, property, or jewelry, to pay for healthcare expenses. These distress sales can have long-lasting repercussions on a family's financial stability and social standing.

Delayed or inadequate healthcare: Families without insurance may postpone seeking medical treatment due to financial constraints, leading to delayed or inadequate healthcare. This can exacerbate existing health conditions and result in poorer health outcomes.

Impact on education and career opportunities: The financial strain caused by high medical expenses may lead families to prioritize healthcare costs over other essential needs, such as education and career opportunities for their children. This can have long-term consequences on the family's socio-economic status and quality of life.

Emotional and psychological stress: The financial burden of healthcare costs, coupled with concerns about the health of family members, can lead to emotional and psychological stress for families without insurance. This stress can impact the mental health and well-being of all family members, further exacerbating their challenges.

Increased poverty and vulnerability: High out-of-pocket healthcare expenses can push families into poverty or deepen existing poverty. This increased vulnerability can limit their ability to recover from financial setbacks and perpetuate a cycle of poverty.

The lack of health insurance in India highlights the need for comprehensive, accessible, and affordable healthcare coverage for all citizens. Expanding insurance coverage, improving public healthcare facilities, and promoting health insurance awareness can help mitigate the adverse effects of not having insurance on Indian families.

The high out-of-pocket expenses in India's healthcare system have profound implications for the financial well-being and health outcomes of its citizens. Policymakers must focus on expanding healthcare coverage, improving the public healthcare system, and promoting preventive healthcare to reduce the burden of out-of-pocket expenses and ensure accessible and affordable healthcare for all.

Overall, the high cost of healthcare in India presents significant challenges for many families, who often struggle to pay for essential medical treatments and services. There is a need to expand healthcare coverage, improve public healthcare facilities, and raise awareness about health insurance options to help alleviate the financial burden on Indian households.