Revolutionizing Risk: The Rise of Personalized Insurance in a Data-Driven Era

Explore how personalized insurance is transforming the industry by leveraging advanced technologies and data analytics to tailor coverage to individual needs.

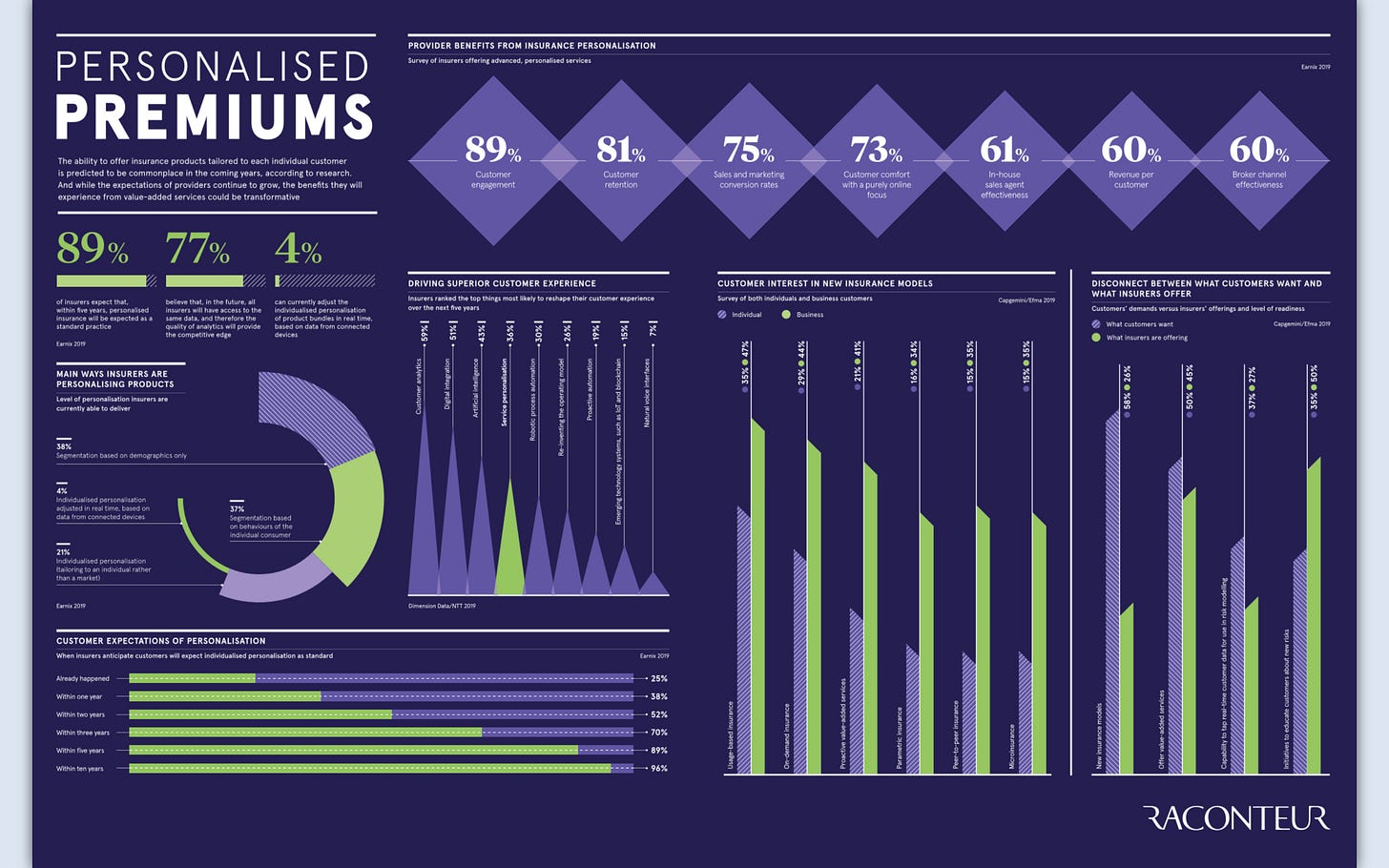

The ability to offer insurance products/solutions tailored to each individual customer is predicted to be commonplace in the coming years, according to research. And while expectations on providers continue to grow, the benefits they will experience from personalization could be transformative.

Personalized insurance solutions mean:

a much more flexible insurance coverage, not just to address today's needs of the customers but also a responsive solution allowing them to quickly tailor it to their changing/evolving needs in their customer journey(coverage type, quality, and limits, add-ons/features on demand, top-ups, deductibles, geo expansion/jurisdiction, premium paying flexibilities, pause/resume etc.), hence improved transparency in product structures will be a big enabler.

Product portfolio simplification

Data Optimization across the insurance value chain to create a data ecosystem

More modern, robust core system and system interoperability

Eagerness to cannibalize the current/traditional insurance business model

[Via Ashish Jhajharia - https://www.linkedin.com/in/ashishjhajharia/]

Personalized insurance is set to revolutionize the industry by offering tailored solutions that cater uniquely to each customer’s lifestyle, needs, and preferences. Leveraging the latest technological advancements and data analytics, this approach promises considerable benefits to both insurers and customers, though it comes with its own set of challenges and considerations.

Benefits of Personalizeurance Solutions:

Flexible Coverage: Personalized insurance adapts to individual lifestyles, allowing customers to modify coverage levels, deductibles, and even add-ons as their life circumstances change. This flexibility includes options like adding renters insurance when moving into a new apartment or enhancing health coverage with the arrival of a new family member.

Transparency: Traditional insurance products can often be complex and difficult to understand. Personalized solutions aim to simplify these details, providing clear and straightforward information about what customers are purchasing. This increased transparency helps build trust and enhances customer satisfaction.

Product Simplification: By focusing on personalization, insurers can offer a more streamlined array of products. Instead of overwhelming customers with numerous complex options, companies can provide a few customizable base plans that can be tailored to specific needs, making the selection process easier and more user-friendly.

Data-Driven Decisions: The use of data analytics is crucial in personalized insurance. Insurers can gather and analyze data from various sources to create products that are more closely aligned with individual risk profiles and preferences. This not only helps in customizing offerings but also in optimizing pricing strategies based on detailed customer insights.

Modernized Systems: To support the dynamic and flexible nature of personalized insurance, robust core systems are necessary. These systems must be capable of integrating seamlessly with external data sources and updating coverage in real-time as changes occur in a customer’s life.

Disruption of Traditional Models: Personalized insurance represents a shift from the generic, one-size-fits-all approach to a more tailored methodology. Insurers that adopt this new model can differentiate themselves in a competitive market and are likely to see improved customer retention and satisfaction.

Enhanced Customer Experience:

One of the most compelling aspects of personalized insurance is the enhanced customer experience it offers. By tailoring insurance products to the specific needs and preferences of individuals, companies can deliver a service that feels much more relevant and valuable to each customer. This customization extends not only to the type of coverage offered but also to how and when interactions occur, with technology enabling more timely and proactive communication.

Adoption of Emerging Technologies:

The deployment of emerging technologies plays a crucial role in enabling personalized insurance. Artificial intelligence (AI) and machine learning (ML) are at the forefront, analyzing vast amounts of data to provide insights that help insurers better understand their customers. The Internet of Things (IoT), particularly in health and home insurance, allows for real-time data collection, enhancing risk assessment and policy adjustment capabilities. Blockchain could also play a role by ensuring the integrity and security of the massive amounts of data involved.

Predictive Analytics and Risk Assessment:

With personalized insurance, predictive analytics can transform risk assessment from a reactive to a proactive practice. By analyzing existing data, insurers can predict future needs and risks, offering products that anticipate rather than merely react to circumstances. This shift not only improves the accuracy of risk modeling but also enhances customer satisfaction by offering solutions before problems arise.

Economic Impact and Efficiency:

Personalized insurance also has the potential to improve economic efficiency within the insurance industry. By reducing the mismatch between the product offerings and customer needs, insurers can decrease the incidence of over-insurance or under-insurance. Efficient coverage directly translates to cost savings for both the provider and the insured, which could lead to more competitive pricing and better coverage options across the market.

Challenges and Considerations:

While the benefits are significant, the challenges in implementing personalized insurance are not trivial. Beyond the need for advanced technological infrastructure and regulatory compliance, there is also the issue of cultural change within insurance companies. Shifting from a product-focused to a customer-focused approach requires changes in organizational structure, compensation models, and even corporate philosophy.

Customer Privacy: With a heavy reliance on data, maintaining customer privacy is paramount. Insurers must implement stringent cybersecurity measures and maintain transparent data usage policies to protect sensitive information and build trust with their clients.

Regulatory Compliance: The insurance industry is highly regulated, and any new approach such as personalized insurance must comply with existing and evolving regulations. Ensuring fair practices in data collection and risk assessment is essential to avoid legal pitfalls.

Legacy Infrastructure: Many insurers operate on outdated systems that may not be equipped to handle the demands of a personalized approach. Upgrading these systems to support new functionalities can be costly and time-consuming but is essential for the effective implementation of personalized insurance.

Market Opportunities and Future Outlook:

Emerging markets and innovative product development are significant areas of opportunity. Usage-based insurance (UBI) and on-demand insurance models are gaining popularity, providing options for customers who prefer paying for insurance based on how much they use it or when they need it. Personalized insurance opens up possibilities to tap into new customer segments and emerging markets, offering growth potential in regions with untapped customer bases.

As we look forward, the trajectory of personalized insurance seems poised for rapid growth. Insurers that can navigate the technical, regulatory, and ethical challenges will likely emerge as leaders in a more responsive and customer-friendly market. Continuous innovation and adaptation will be key, with a focus on sustaining customer trust and balancing innovation with privacy.

By embracing personalized insurance, the industry can move towards a model that not only meets the current expectations of consumers but also anticipates their future needs, creating a more dynamic, fair, and efficient insurance landscape.

Personalized insurance is poised to offer a win-win scenario for both insurers and their customers by providing relevant, adaptable, and straightforward insurance solutions. However, for insurers to fully capitalize on the benefits of this trend, effectively navigating the associated challenges will be crucial. By modernizing systems, ensuring compliance with regulatory standards, and protecting customer privacy, insurers can successfully leverage personalization to enhance their offerings and achieve greater customer loyalty and market competitiveness. This transformative approach is not just a trend but a pivotal shift towards a more personalized and customer-centric future in the insurance industry.