Insurance Selling through MiO Sales

Insurance agents are the consummate salespeople. So, I’m probably preaching to the choir when suggesting that cross-selling will grow business. Agents already know it is important. Many of them actively bring cross-sell opportunities to their clients every day.

But most insurance agents are not using technology and data analysis to identify every opportunity, and this way, leave significant money on the table. With better use of technology and data, agents can increase their sales funnel by 20% to 30% simply with cross-sell opportunities within their current client bases.

Insurance Sales Process Update

As it was with many industries, the traditional insurance sales process from this particular provider was vendor-driven. Insurance agents grabbed the attention of prospects by interrupting whatever they were doing at that time, probably through an unsolicited phone call or email, and proceeded to try and sell whichever policy was hot at the time. The insurance agent had little information on who they called and for the most part (to them) neither bothered or cared to find out – they had a target to hit and that was it.

In the insurance sector- “Sales” is no longer just a numbers game – it’s a people game.

The customer-seller relationship shifted dramatically over the past 15-20 years. Prospects now come to the table armed with a wealth of knowledge of various policies and prices from your company as well as your competitors. This means the customer now owns the conversation – they are the ones who decide who they want to contact, when and on their own terms. What’s more, this entire information gathering process is conducted digitally as they source over 95% online.

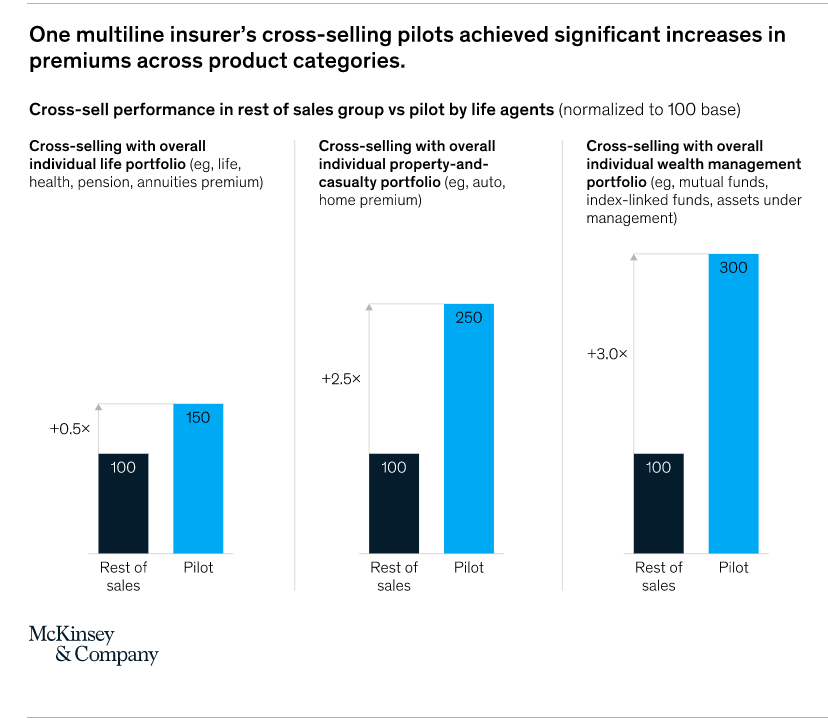

Customer-relationship building has a direct impact on both margins and how insurers compete—and there is the significant value at stake. A recent benchmark analysis of more than 20 insurers offering life, health, and pension coverage in Europe and the United States found that the average insurance company had a per-customer product density of 1.2 to 1.5.

Among insurers (and their agents) with deeper customer relationships, overall product density rose to two products per customer—or even three or more in some instances, which may indicate that those insurers have made it much more convenient for their customers to cover their full set of needs.

With this shift to a customer-centric sales process digital transformation in insurance is now a business priority.

Independent agents are incredibly busy working to provide the best coverage to their customers. Finding cross-sell prospects is often a multi-step approach that includes manually running agency management reports and composing individual communications about the specific opportunity. It’s labor-intensive, so cross-selling is often pushed to the bottom of the to-do list.

Technology changes the game. It uncovers new opportunities that agents might never have been able to see.

McKinsey's research suggested that automation could reduce the cost of a claims journey by as much as 30%. Technology can also prevent challenges like cybersecurity threats through accurate predictions.

According to U.K.-based firm Autonomous Research, AI and machine learning could replace over $1 trillion of the current financial services cost structure. While agents continue to interact with clients via phone, in person and over the internet, carriers are experimenting with technology to increase direct interaction with clients.

Insurance carriers are already working with insurtech companies to explore the benefits of robotics and AI to understand customers’ preferences and provide personalized solutions in real-time.

Here are some of the tangible benefits of automating insurance sales:

Simplified processes: A single system controls the entire end-to-end process with a simple drag-and-drop interface.

Digital tools in one digital suite: At various stages of the workflow, rules trigger the sending of requests for eSignatures and ID verification, as well as sharing disclosures such as T&Cs for customer approval.

More streamlined processes: Easy and intuitive conditional rules can be set to ensure business logic between steps, within steps, and within form fields.

Optimized: Each sales interaction can be optimized across touchpoints and existing systems.

More visibility: Digital workflows come with dashboards that allow business leaders to gain visibility into the KPIs that matter most, such as sales cycle time and cost of sales.

Zero IT involvement: Project managers can adjust their business rules according to their needs without requiring IT support or coding.

Top Use Cases for Insurance Sales Automation

Live Product Presentations- Gone are the days of PowerPoint insurance sales presentations or worse, in-person presentations. Automated digital workflows allow agents to create an “order” showcasing potentially relevant insurance products, and sharing them in real-time with customers in a collaborative mobile environment.

Shared Review of Documents & Agreements- Once the customer expresses interest in purchasing a certain insurance product, the sales agent shares a document with the customer for an in-call review. The agent and customer can zoom in and mark up specific parts of the document to clarify queries collaboratively.

Instant Consent- Instead of the sales agent reading lengthy compliance scripts, damaging the customer experience, agents can simply send terms and conditions to a customer’s mobile phone for instant click consent.

eSignature Collection- Once the customer agrees to purchase an insurance product and reviews the final order, the workflow automatically triggers a request for the customer’s electronic signature. The customer signs in the moment via the text message interface and an audit trail of the signed document is produced and stored in the CRM.

Automatic Payment Collection- Sales agents can set up newly signed customers with an automatic payment plan for their insurance premiums. The workflow sends out ACH forms for the customer to fill out, making it easy for customers to pay premiums regularly and automatically.

In a nutshell, Automated digital workflows allow insurance companies to dynamically build and adjust processes to meet their current needs. This flexibility means that customer relationships with insurance agents are more targeted. Customers are asked to provide only the information that is needed from them, no more and no less. Automated workflows ensure insurers keep the ball rolling between critical steps in the insurance sales cycle, promoting both better compliance and efficiency.

Artivatic.ai offers such a workflow automation platform that uses conditional logic to streamline end-to-end insurance sales processes.

Artivatic’s MiO Sales Platform is a new-age sales, marketing & customer relations platform that drives efficiency, scale, customer intelligence, performance, and ROI to businesses.

MiO Sales is built with empathy, need, and with the use of data-driven insights which provides next-gen insurance sales platform.

Some of the core benefits are:

Prospecting and Capturing Leads.

In-built webinar/meetings and onboarding

Lead profiling & scoring

Managing partners /FLS/Sales team

Location-based intelligent for partners/sales team /FLS

Manage customers, understand their behaviors

Real-time communication, video, and calling

Recording, sharing, and collaboration

Product-wise insights

Recommendation and Activities

Customer, Location wise insights

MiO is a next-gen insurance sales and distribution platform that help business to:

Improving customer experience

Enhancing sales process

Better insights and performance

Reducing cost

Increase revenue

Automated Operations

If you want to learn more about our platform, please click on this link: www.miosales.com

Or

Connect to us @ www.artivatic.ai