Insurance Sales Revolution

The insurance landscape has evolved far beyond what it used to be. One major change relates to the way customers find and purchase coverage. Today’s insurance buyers demand a technology-inspired experience that can be done almost entirely virtually, and it’s reshaping the entire insurance industry.

Changes in customer behavior are causing a fundamental shift in the insurance distribution model. Consumers are embracing digital channels, and their experiences with leading tech companies have also raised their expectations when buying insurance both online and offline. A seamless, consistent “multi-access” experience across all touchpoints is now the standard that all companies must strive to meet. The bar is also being raised by insurtechs. Investments in insurtechs worldwide grew from $0.3 billion in 2003 to $5.8 billion in 2020, and the unique selling proposition of many emerging players is based on a digitally enhanced customer experience.

Peeping in the Past

Traditionally, insurance companies had agents and brokers designated as the primary interaction channel with their customers. The insurance industry has long resisted change, and while everyone talks about the rise of Insurtechs, independent agents have a tough choice ahead. They can continue on the current path, preparing paperwork and handling customer renewals manually while having to turn away customers looking for specialty products. Or, they can work with willing InsurTechs, using tech advances to capture underserved parts of the market that have traditionally taken too much time and paperwork with low profit.

The pain points are clear:

Brokers today spend a significant amount of time quoting and binding policies for their clients, in addition to generating and updating certificates of insurance.

They are in need of a solution to streamline workflows, lower costs, and accelerate the time it takes to deliver products and services.

Meanwhile, InsurTech companies — with products designed to fit the dynamic needs of digital-age customers and simplify the process of buying insurance — are equipped to address those issues while helping brokers make commission with virtually no hassle.

For personal lines policyholders, non-traditional, technology-based insurance companies offer customers on-demand, pay-as-you-go coverage options that simplify the underwriting process. On the benefits side, clients and their employees want more transparency and self-service options when it comes to their health and ancillary benefits. Providing self-service portals for plan documents claims submissions and online enrolment is no longer a way to differentiate from the competition—it’s a standard offering those clients expect. And, these expectations are growing by the day.

Technology, when implemented correctly, can actually expand the insurance market more broadly. For instance, 40% of sole proprietors in the U.S. currently do not have business insurance, while 75% are underinsured. Tailoring affordable, innovative offerings to this un- and underinsured population — and making those offerings available through broker channels — can spread access to coverage and ultimately protect more business owners from risk.

What Are Today’s Insurance Customers Looking For?

Online access to account data and customer service

24/7 access to expert advisors

World-class content

Omnichannel engagement

Hassle-free claims management processes

Timely risk management advice delivered to them digitally

The regions where insurance penetration is low pose an immense potential for the digital premium market. Insurers can leverage the following distribution channels to undermine the profound potential.

Self-directed or Direct Distribution Channel- Online channels, websites, social media platforms, e-commerce, and kiosks are some examples of direct distribution channels in insurance. The direct insurance distribution channel encourages self-service and independent decision-making. NLP-powered chatbots are a great way to provide a self-service portal for buying/renewing insurance policies. Leading Insurers are leveraging the direct distribution channel by integrating chatbots in different platforms like their website, mobile app, and even on third-party apps like WhatsApp.

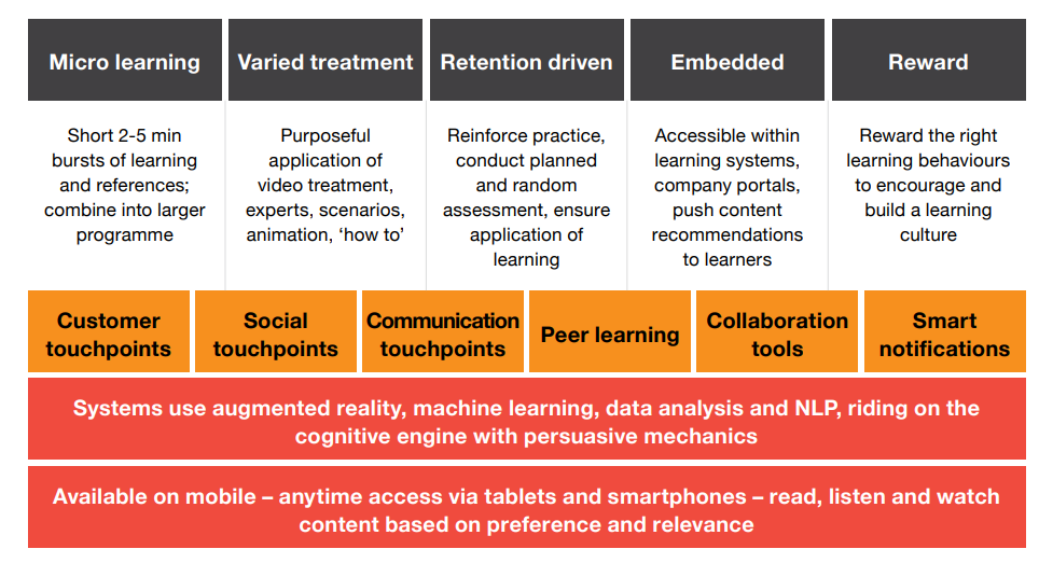

Assisted Distribution- Agents, insurance brokers, and reinsurance brokers remain the most recognized insurance purchase channel. The Gartner Group reports that 60% of the US GDP is sold through assisted or indirect channels. Cognitive technology is becoming a key enabler to strengthen the assisted distribution channel. PwC suggests leveraging analytics solutions (mainly predictive analytics and behavioral analytics) to increase sellers’ knowledge as well as skills. The technologies that are empowering learning for Insurers include augmented reality, machine learning, data analysis, and NLP.

Affinity-based Insurance Distribution Channels- Traditionally, the affinity-based distribution channel involved peer-to-peer networks, brokers and aggregators. While the network model remains the same, the model has become digital and tech-driven for affinity channels. And technology is playing a vital role in expanding the consumer base. The key benefits of the affinity distribution channel are-

Common platform for all stakeholders.

One-stop access to policies and claims.

Centralized database for insightful analysis.

This distribution channel is also a part of B2B2C or API-based insurance business models. Here, Insurers can leverage 3rd party apps to distribute their policies. APIs or Application Programming Interfaces are lightweight programs to extend the functionality of existing apps. Travel, airbus, hotel, bank, and retail are some examples of affinity-based distribution channels.

In a nutshell, the insurance industry has long relied on tied agents for sales, and these networks remain the most important sales channel for a considerable number of insurers. To address the needs of multi-access customers, the strategy of choice for many of these companies is to start with the digitization of the existing agent channel.

The main goal of this approach is to support the sales activities of the existing agent network by using digital tools to enhance the customer experience. The role of the direct channel is often to provide information and the first point of advice for customers. Examples include the following areas:

Digital customer interaction

Increased visibility, accessibility, and reach

Multi-access skill building

Interfaces for seamless channel switches

While executives understand that they must fully embrace the digital possibilities to support a multi-access offering, the best solution can vary based on an insurer’s strengths and structure. By choosing the right multi-access approach, carriers can be well-positioned to serve evolving customer needs.

Please share your thoughts in the comment section.

To know more, click here: https://miosales.com/home