How Automation is reshaping the Insurance workforce in 2022

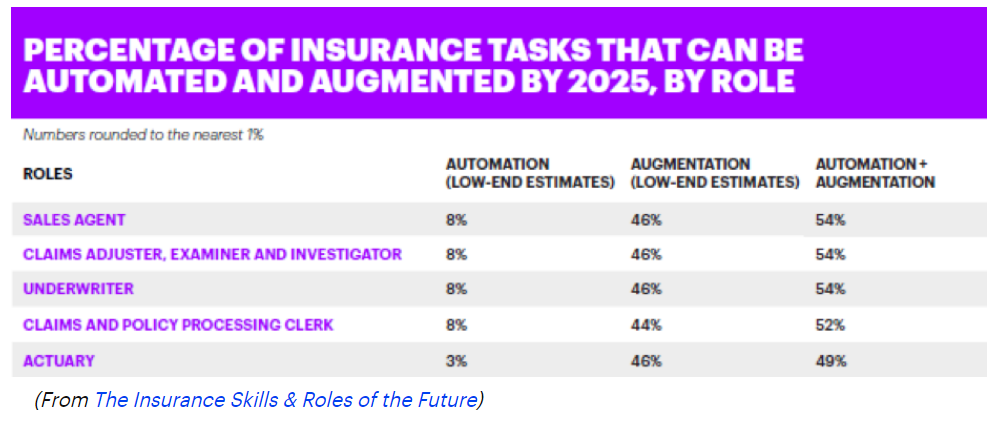

According to McKinsey Global Institute report, 2017, there is 43% of automation potential for the Insurance and Finance industries. By 2025, up to 25% of the task force in the insurance industry may be consolidated or replaced, especially in Operations and Administrative Support.

The insurance industry is now aggressively looking at use cases for intelligent automation as AI, Machine Learning & Cognitive tools are merged with Robotic Process Automation (RPA) to bring efficiencies into existing processes and reduce operational costs.

Challenges and Opportunities in the Insurance Industry

Traditionally, premiums paid by customers were being invested by the insurance companies into a number of financial instruments to get good returns. However, in today’s low-interest-rate scenario, this source of income has dried up. The online P2P insurers with minimal brick and mortar infrastructure are offering low rates making the market much more competitive and tougher.

Moreover, insurers are moving cautiously when it comes to embracing automation and other tech tools, and for good reason. As technology changes the insurance industry, challenges arise that appear in a few other verticals.

Nonetheless, business automation is set to change nearly every industry, Deloitte argues, and insurance companies can certainly benefit from the efficiencies that automation will introduce. Data collection, analysis, and decision-making, once the sole domain of humans, can now be improved by automation and AI. These tools range from simple time-savers, like auto-completion during data entry, to complex pattern recognition and data mining, which is transforming the way we analyze risk.

Further, automation offers numerous opportunities to improve efficiency, retain customers and reduce errors — but only when automation is enacted thoughtfully, as Corrine Jones notes at Property Casualty 360. Here, we look at five obstacles to automating agency operations, plus ways to overcome them.

The insurance industry runs on vast reservoirs of data, dealing with mixed data formats which include both paper and electronic documents. The manual effort to extract information from these documents and different data sources is not only considerable but also costly and prone to errors.

The larger insurance companies use a complex IT environment that comprises multiple legacy applications and disparate systems. This results in operational inefficiencies and unnecessary costs spent on administrative functions.

Besides issuing policies and processing claims, there are tons of backend processes that are manually intensive, time-consuming, repetitive, and prone to errors. Some examples of such back-end processes are policy quotes & servicing, underwriting, drafting receivables & payables, renewing premium, identifying premium discrepancies, conducting compliance and legal/credit checks, etc.

Like any other business, scalability is another issue that comes into play during seasonal peaks in the insurance industry. It gets challenging further during the events of a large-scale catastrophe which requires the claims process to be efficient and accurate to process a large volume of claims.

Changes in the nature of work for Frontline workers

Insurers also need to reassure their workforce that automation and augmentation won’t ‘take away’ their jobs, and their customers that they will still be able to talk to a person when they need to.

Rather than removing the human touch, automation will help insurers offer personalized and human experiences at scale. By automating the front- and back-office tasks, insurers will have opportunities to provide workers with meaningful work and to emphasize relationships rather than routine transactions. Our research suggests that by putting algorithms back ‘under the hood’, AI and other intelligent automation tools will free people to do what they do best: inspire, create, influence, lead, judge, problem-solve, and counsel.

Let’s have a look at Insurance Automation use cases.

Smart Media Reader: The insurance industry deals with piles of paperwork during policy issuing and claims process. The paper documents are scanned and stored in their digital repository for respective back-office operations teams to manually extract relevant data and enter it into the front-end policy and claims systems.

This is inefficient, error-prone, and repetitive, which can be streamlined with minimal human intervention using intelligent automation. A smart media reader solution can be developed using Robotics Process Automation (RPA) which can read and extract relevant data from scanned documents. The solution can use OCR capabilities to read data; use smart references, NLP, and machine learning capabilities to validate & process data; and interface with relevant systems to perform automatic reconciliation. The solution can be integrated with existing processes where there is a heavy reliance on extracting data/information from paper documents.

Optimized Claims Processing: Claims processing is one of the functions in the insurance industry that is primed for automation. This process is tedious and labor-intensive and suffers from human error, extended wait times, and massive data processing. A partnered effort between RPAs, cognitive automation systems, and a human insurance agent, significantly reduces the friction experienced by both insurers and customers.

When a claim is submitted, an RPA may be able to pull out relevant information from a variety of sources and send it to a cognitive automation system. This system can then analyze the information and approve the claim or, if there’s an issue, send it to a human agent. When the agent makes a decision, the cognitive automation system learns from his or her behavior. This method reduces waiting times by up to 50%.

Smart Underwriting Solution: One of the most classic debates of all time in the underwriting world is whether – ‘Underwriting is an Art or Science?’ We believe it is both, and therefore, the solution needs to have provision for both. A rule-based RPA solution can be built for an underwriting system where it will determine if a submission or renewal is a candidate for an automated or a hybrid process. Under the automated process, the rules, predictive models, and machine learning algorithms will evaluate, rate, and price a submission. In case of more complex submission, a hybrid process can be used where underwriters will use their art and knowledge, supported by recommendations generated by the solution.

Using OCR For Claims Processing- One of the biggest drains to insurers is the efforts expended on simple data entry tasks, particularly those of paper forms that need to be read and input by a human agent. Part of the difficulty in automating this process came from recognizing the handwriting of customers. However, with OCR technology, such as Automation Hero's, a cognitive automation system can review a scanned file and effectively read and input the data itself. This can be used in most insurance claims, from medical claims to vehicular claims. Many documents need to be submitted as proof to any given claim, some of which are inevitably handwritten. For example, a doctor’s note on a medical claim.

The Role of Start-ups in shaping the industry

Start-ups provide a valuable source of innovative ideas to insurtech and the wider insurance industry. They are the groundbreakers when it comes to new technologies and refining their applicability to specific industries. These growing companies harmonize cutting-edge tech with their target industry through intensive research and investor input. This is indicated through the rise of insurtech start-ups from outside the insurance industry where 31% of insurers plan on working with startups from outside their industry in the next two years.

It is evident that the role of insurtech startups is strong, and growing even stronger. They’re releasing new technologies and they’re the reason why many large corporations are evolving in order to stay relevant.

Way Forward!

Insurers are on the edge for rising startups in the insurtech sector, as well they should be. The future of the insurers is heading towards a fully integrated insurtech system that incorporates automation on a multilevel basis. It is true that the earlier these integration efforts are implemented, the fewer downtime companies experience, and the sooner they see a return. This is particularly important in cognitive automation technologies as the learning curve and integration into existing systems take some time.

With the constant emergence of challenges driven by disruptive technologies, intense competition, and complex markets, the insurance sector is looking at optimizing costs, improving overall accuracy, and maximizing returns. Intelligent automation can be used to quickly automate key processes to achieve higher efficiencies and streamline operational costs. This will enable professionals to focus more on value-added functions driven by smart solutions and contribute efficiently to overall organizational objectives.

Are you ready to take the next step for your company’s digital transformation? Talk to us at contact@artivatic.ai