How Artificial Intelligence helps in Risk management in Insurance Industry

Artificial Intelligence is no more a buzzword. AI concepts and approaches are transforming the operating methods of the economy and society. Every business sector has rolled out Artificial Intelligence be it medicine, auto industry, finance, manufacturing, agriculture, or marketing.

Similarly, even insurance industries are leveraging the benefits of AI. Artificial Intelligence adoption among insurers is rolling rapidly, especially since the pandemic hit the companies. Now, insurance companies are forced to shift from relying on personal interactions to digital interfaces.

According to a study by Deloitte, Artificial Intelligence adoption could be one of the biggest game-changers for the insurance industry in the next 10 years.

Over the past decade, insurance companies have focused more on maintaining the legacy system. Hence the manual processes generally come up with multiple issues like:

Manual or physical clearance

Delay in processes

No fraud & risk analysis

Error rates are very high

Leads to high risk

No learning or analytics

Inefficient process

Increase in cost

Customer dissatisfaction

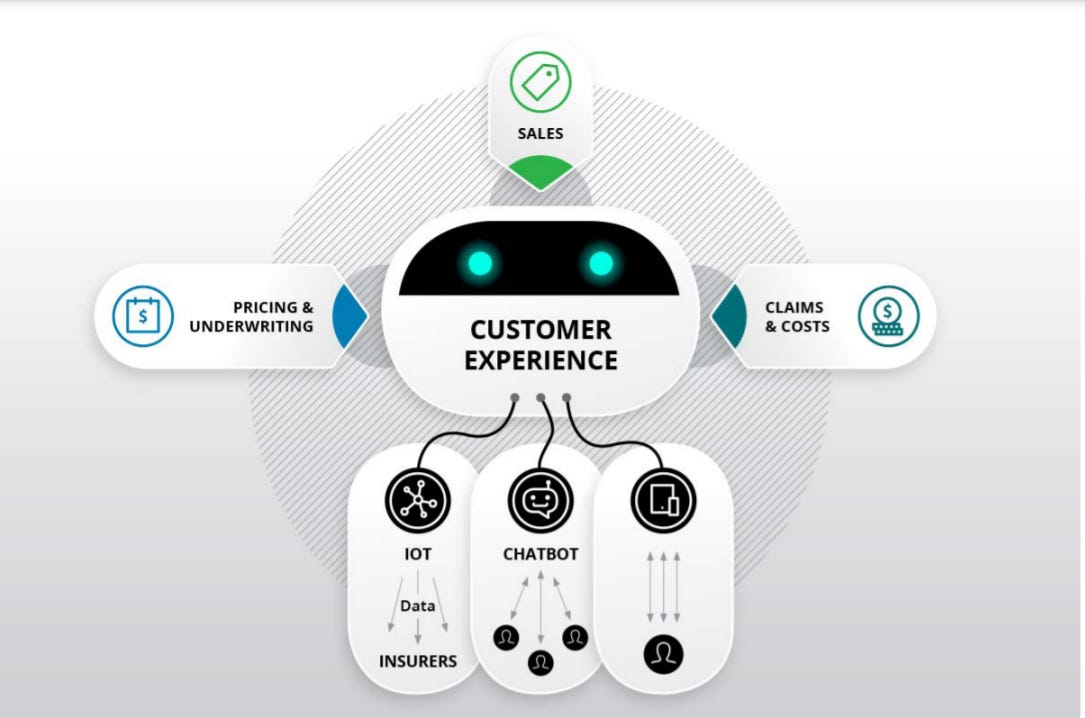

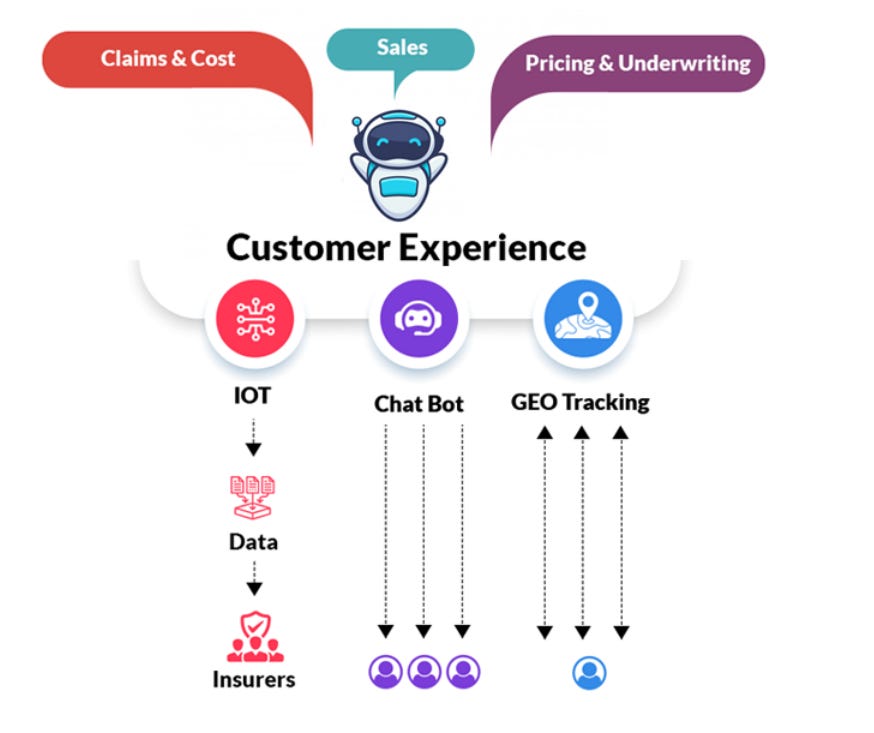

The focus has shifted on data transformation initiatives in the interest of building a robust data foundation. Hence to collect the richness of data, insurance companies have moved beyond policy and claims data which has been enhanced by the advancement of user-based insurance products and IoT devices. Hence to operate this data, companies are now deploying modern analytics platforms to empower business users.

Furthermore, this data ecosystem compels us to form a perfect propagation platform for the conception of Artificial Intelligence and Machine Learning. The demand is across many operational processes of insurance companies like underwriting, pricing, claims, etc. Henceforth AI helps is transforming risk management in the areas of claims and underwriting. Insurers are leveraging AI to enhance risk management tasks, extract pertinent risk information to identify underwriting risks, and optimize risk selections like:

Credit risk

Operational risk and governance, risk and compliance (GRC).

Market risk

Asset and liability management (ALM) and liquidity risk.

Energy and commodity trading risk

Financial crime including trader surveillance, anti-fraud and anti-money laundering

Cyber risk management

Insurance risk

With the global AI market estimated to grow at a CAGR of 42.2% to $733.7 billion by 2027, AI and machine learning use in insurance are only bound to grow.

In a nutshell, insurtech sectors are enabling smart claims processing for insurance enterprises which further leads to lowering the risk management with technologies like Artificial intelligence, Machine Learning, Image Recognition & Neuroscience.

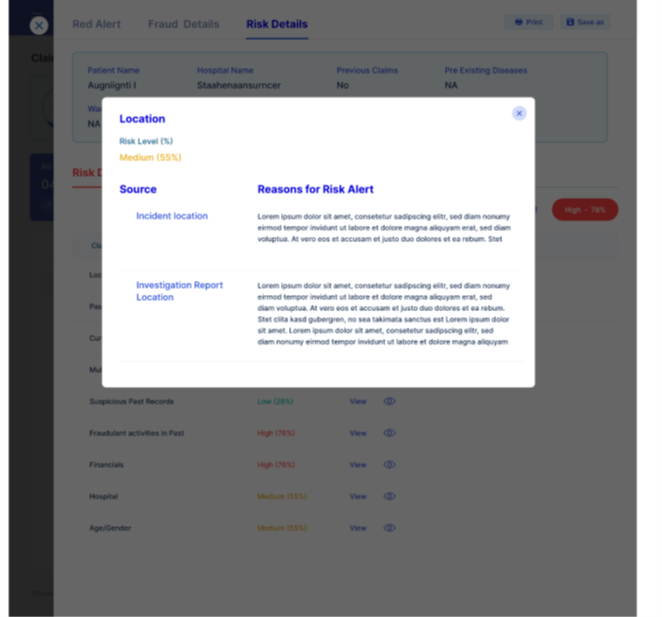

Insurtech platforms are using inbuilt AI & Data models to provide claims, detect risk & fraud insights in real-time. It enables in reducing investigation and fast track claims settlement with lesser risks.

One such company is Artivatic that lowers the risk management and fast-track claim settlement. The AI-built technology platform- ALFRED uses multiple types of data to ensure in-depth patterns and reduce the risk.

Looking for a proven technology partner? Talk to us today about your challenges.

Write to us at layak@artivatic.ai

#ArtificialIntelligence #Claims #RiskManagement #Insurtech #Artivatic #Technology #InsuranceIndustry