Embracing the Future: How Artivatic.ai is Pioneering Digital Transformation in Insurance

Artivatic.ai is spearheading digital transformation in insurance, leveraging AI and machine learning to enhance underwriting efficiency and risk management, as detailed in a NASSCOM report case study.

In an era where the digital landscape is constantly shifting, industries across the board are embracing innovation to meet new consumer demands and stay ahead of the curve. The insurance sector, traditionally seen as cautious and conservative, is no exception to this digital revolution. A recent report by NASSCOM, "Digitalizing Insurance: An Indian End-Consumer Perspective," sheds light on the significant strides made towards modernizing insurance services.

The Imperative of Digitalization: Digitalization is not merely a trend; it's a strategic imperative that has permeated every aspect of consumer interaction and service delivery. For the insurance sector, this means adopting new technologies that align with the needs of a digital-savvy consumer base. The stakes are high, and the benefits are clear: improved efficiency, enhanced customer experience, and innovative product offerings.

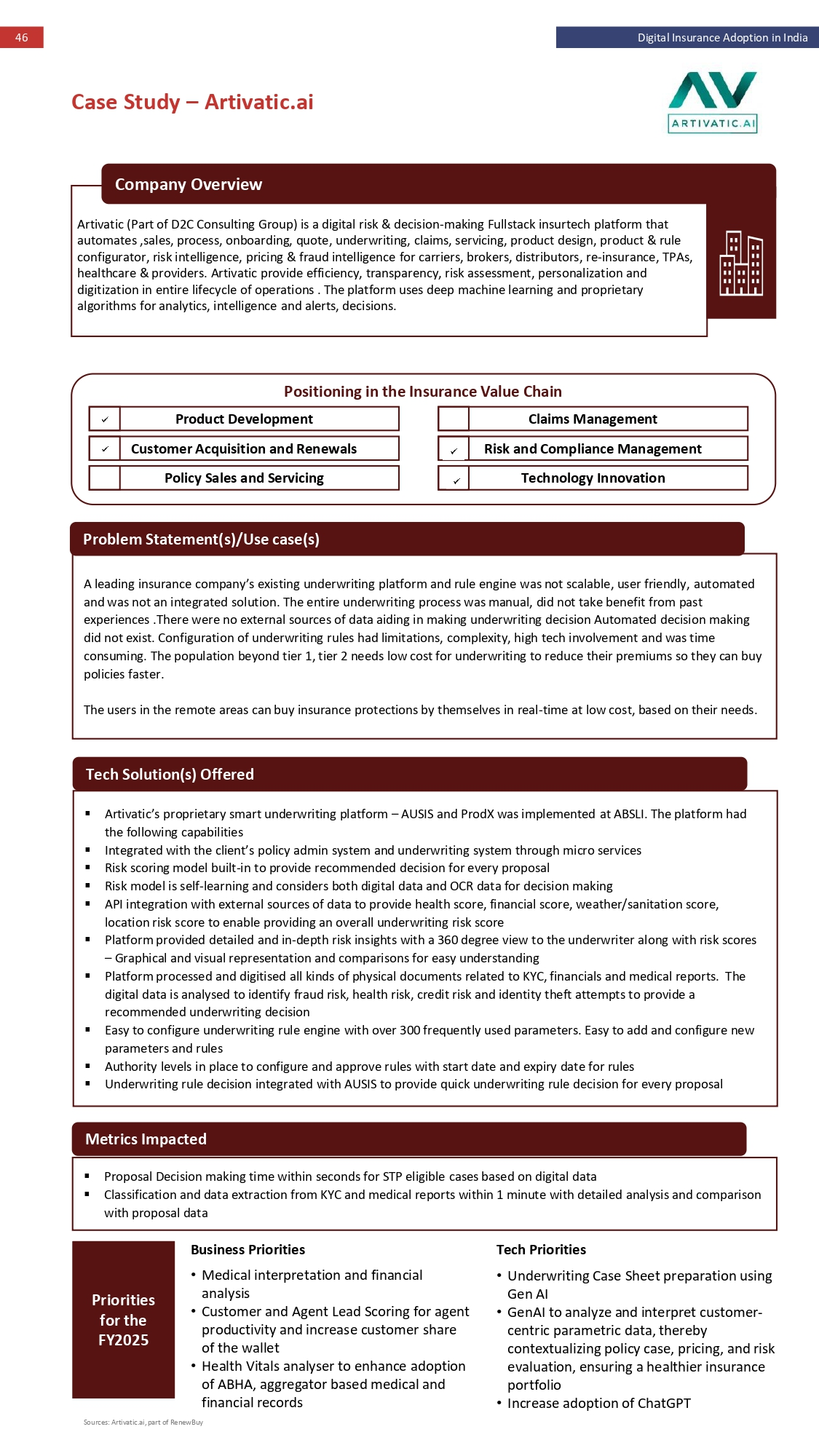

Artivatic.ai's Trailblazing Journey: At the forefront of this transformation is Artivatic.ai, a company that has redefined the concept of underwriting in insurance. The case study featured in the NASSCOM report provides a detailed look at how Artivatic.ai collaborated with Aditya Birla Sun Life Insurance (ABSLI) to implement their cutting-edge platforms, AUSIS and ProdX.

Key Innovations and Impacts:

Self-Learning Risk Models: Artivatic.ai developed a self-learning risk scoring model that flawlessly integrates with existing systems, setting a new standard for adaptive risk assessment in the insurance industry.

Comprehensive Risk Assessments: By leveraging external data sources, Artivatic.ai can provide insurers with a complete risk profile, ensuring a more informed and accurate underwriting process.

Digital Processing and Document Digitization: The ability to process documents in real-time has significantly boosted fraud detection capabilities and risk management strategies.

Efficiency in Decision-Making: Perhaps the most striking impact is the reduction in decision-making time for proposals—cut down to seconds, illustrating the efficiency gains made possible through digitalization.

Reimagining the Industry: Artivatic.ai's initiative goes beyond streamlining operations. It's about reimagining them to foster a more robust, risk-aware, and customer-centric insurance ecosystem. The advancements have paved the way for insurers to not only understand and serve their customers better but also to operate with unprecedented agility and insight.

Looking to the Future: As we delve into the details of Artivatic.ai's case study, it's clear that the company is setting new benchmarks for the insurance sector. But what does this mean for the future of risk and compliance management? How will these innovations influence the global insurance landscape?

The NASSCOM report and Artivatic.ai's case study offer a fascinating glimpse into the transformative power of digital technology in insurance. As we continue to navigate this digital era, it is companies like Artivatic.ai that lead the charge in redefining what's possible, promising a future of insurance that's more efficient, more responsive, and more attuned to the needs of the modern consumer.

Discover the depths of this digital transformation by reading the full NASSCOM report, and join the conversation on how technology is redefining the insurance industry: https://nasscom.in/knowledge-center/publications/digitalizing-insurance-indian-end-consumer-perspective