Digital Transformation in Bancassurance: Boosting Sales through Innovative Technology Integration

Revolutionizing Bancassurance: Embracing Digitization and Modern Technologies for Enhanced Sales

Bancassurance has evolved significantly over the years, with banks and insurance companies entering into strategic alliances to offer insurance products through banking channels. As this distribution channel continues to gain popularity, there is a pressing need for the industry to adapt to the rapidly changing digital landscape.

Current State of Bancassurance

Despite the growth of bancassurance, there are still several challenges faced by banks and insurers, including:

Inefficient Sales Processes: Traditional sales methods such as face-to-face meetings and paper-based applications have proven to be time-consuming and prone to human error.

Limited Product Offerings: Due to a lack of digital tools, banks may struggle to offer a comprehensive range of insurance products tailored to each customer's needs.

Regulatory Compliance: Banks and insurers must constantly update their systems to comply with ever-changing regulatory requirements.

Training and Development: Ensuring that bank employees have the necessary skills and knowledge to sell insurance products effectively can be resource-intensive.

The Need for Digitization and Modern Technologies

To overcome these challenges and unlock the full potential of bancassurance, banks and insurers must embrace digital transformation and incorporate modern technologies, such as:

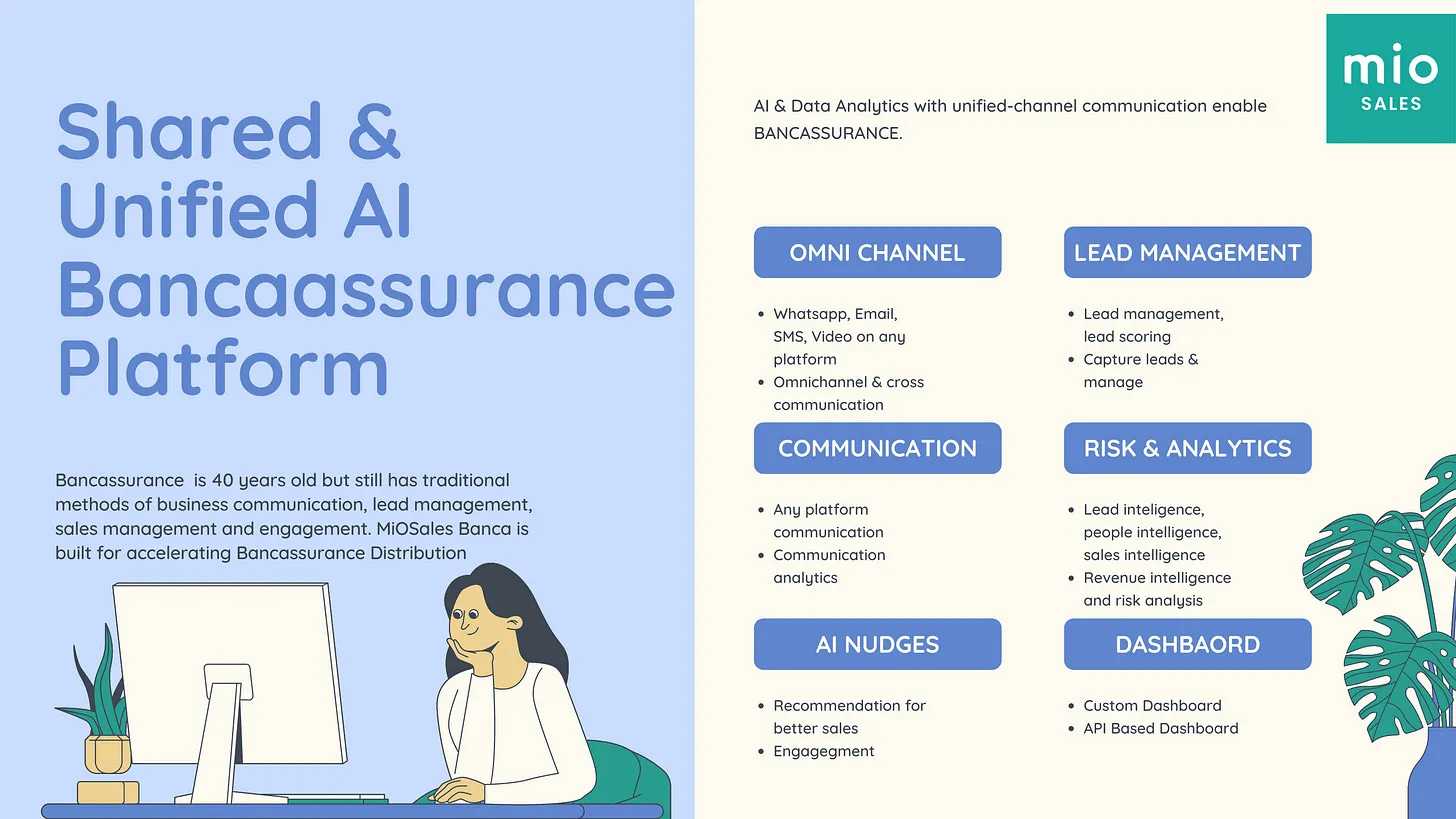

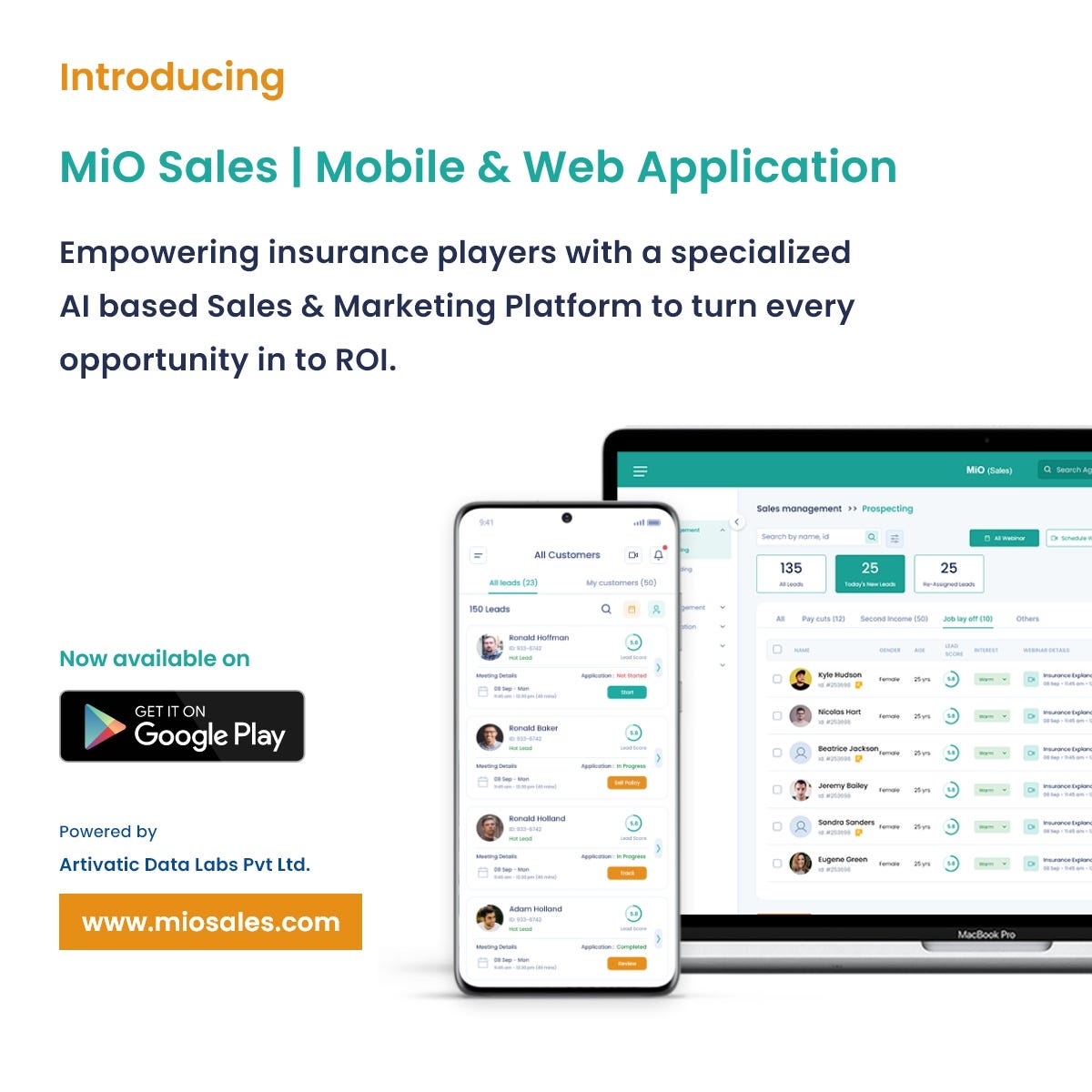

MiOSales with AI/ML: This platform leverages artificial intelligence and machine learning to provide banks with a more efficient and effective sales process by automating routine tasks and offering personalized product recommendations.

ChatGPT: By implementing AI-driven chatbots, banks can engage customers 24/7, answer their queries, and guide them through the insurance application process, leading to a higher conversion rate.

WhatsApp and Video Communication: These tools enable seamless communication between customers and sales representatives, reducing turnaround time and enhancing customer experience.

Location Intelligence: By analyzing customer location data, banks can better understand their target market and develop targeted sales strategies.

Sales Engagement and Enablement: Modern sales tools help sales teams to improve their skills, access the latest product information, and track their performance in real-time.

Out-of-the-box Government Integrations: Platforms like IndiaStack allow banks to streamline the KYC process and ensure regulatory compliance more efficiently.

AI Nudges and Sales Analytics: AI-driven insights enable sales teams to identify and act on sales opportunities, resulting in improved conversion rates.

Team Profile Insights: By analyzing employee performance, banks can identify skill gaps and provide tailored training programs to enhance productivity.

Quantitative Insights and Benefits

By embracing digitization and modern technologies, banks and insurers can achieve significant improvements in their bancassurance operations:

Increased Sales Efficiency: Digital tools can reduce the average sales cycle by up to 50%, allowing banks to close deals faster and improve customer satisfaction.

Enhanced Product Offerings: With AI-driven product recommendations, banks can increase cross-selling opportunities by up to 30%, resulting in higher revenue generation.

Improved Compliance: Integrating government platforms can reduce KYC processing time by up to 70%, ensuring better regulatory compliance and reduced risk.

Higher Conversion Rates: By leveraging AI insights and sales engagement tools, banks can achieve conversion rate improvements of up to 25%.

In order to stay ahead of the curve, banks and insurers must keep an eye on emerging trends and technologies that could reshape the bancassurance landscape.

Some of these include:

Personalized Customer Experience: Advanced data analytics and AI-driven insights will enable banks to better understand their customers, allowing for highly personalized product offerings and a tailored customer experience.

Omnichannel Distribution: Banks will need to adopt an omnichannel approach to distribution, ensuring that customers can access insurance products through various channels, such as online, mobile, and physical branches.

Integration of IoT and Wearable Devices: As the Internet of Things (IoT) and wearable devices become more prevalent, banks and insurers can leverage the data collected from these devices to offer personalized insurance products and more accurate risk assessments.

AI-Driven Underwriting and Claims Management: The adoption of AI and ML will continue to revolutionize underwriting and claims management processes, resulting in faster and more accurate decision-making, ultimately benefiting both the banks and their customers.

Collaboration with Insurtechs: As insurtech companies continue to innovate and disrupt the insurance industry, banks and insurers should consider strategic partnerships with these companies to stay at the forefront of innovation and remain competitive in the market.

Focus on Cybersecurity: With increased digitization, banks and insurers must prioritize cybersecurity to protect sensitive customer information and ensure compliance with data protection regulations.

Sustainable and ESG-focused Products: As the global focus on sustainability and environmental, social, and governance (ESG) factors increases, banks and insurers should consider offering ESG-focused insurance products that cater to customers' growing demand for responsible financial solutions.

Blockchain-Enabled Solutions: The integration of blockchain technology can streamline processes, enhance transparency, and reduce fraud in the bancassurance space. Banks and insurers can leverage blockchain for smart contracts, secure data sharing, and efficient claims processing.

Gamification and Behavioral Economics: By incorporating gamification techniques and principles of behavioral economics, banks and insurers can improve customer engagement, encourage better financial decision-making, and increase the effectiveness of their sales strategies.

Continuous Learning and Upskilling: To keep pace with the rapidly evolving bancassurance industry, banks and insurers must invest in continuous learning and development programs for their employees. This will ensure that their sales teams are equipped with the necessary skills and knowledge to effectively sell insurance products in the digital age.

Big Data and Predictive Analytics: The use of big data and predictive analytics will enable banks and insurers to gain deeper insights into customer behavior, identify trends, and make data-driven decisions that optimize their sales strategies and risk management.

Digital Ecosystems and Open Banking: As the financial services sector continues to evolve, banks and insurers should explore opportunities to create digital ecosystems and collaborate with other industry players through open banking platforms. This will enable them to offer a more comprehensive range of services and enhance the overall customer experience.

By embracing these trends and investing in the right technologies, banks and insurers can deliver a seamless, customer-centric bancassurance experience that drives growth and strengthens their position in the market. As the future of bancassurance unfolds, organizations that proactively adapt to these changes will be well-equipped to navigate the challenges and capitalize on the opportunities presented by this evolving industry.

Future of Bancassurance with New Age Technologies

The future of bancassurance is expected to be shaped by the continuous integration of new technologies, such as blockchain, IoT, and advanced data analytics. These innovations will further enhance the customer experience, streamline operations, and facilitate more effective risk management. By staying at the forefront of these technological advancements, banks and insurers can solidify their position as leaders in the evolving bancassurance landscape.

The digitization of bancassurance, coupled with the adoption of modern technologies, is essential for banks and insurers to to thrive in an increasingly competitive market. By implementing advanced tools like MiOSales with AI/ML, ChatGPT, WhatsApp, video communication, and location intelligence, banks can enhance their sales processes, improve customer engagement, and increase revenue. Moreover, embracing sales engagement and enablement tools, government integrations, and AI-driven analytics will lead to a more efficient, compliant, and productive bancassurance ecosystem.

As the future of bancassurance unfolds with the introduction of new technologies, banks and insurers that proactively invest in digital transformation will be better positioned to capitalize on emerging opportunities and deliver exceptional value to their customers.

The future of bancassurance will be shaped by the continuous integration of innovative technologies and the adoption of emerging trends. By proactively investing in digital transformation and staying abreast of industry developments, banks and insurers can deliver an exceptional bancassurance experience that meets the evolving needs and expectations of their customers. As a result, they will be better positioned to grow their market share, enhance customer loyalty, and maintain a competitive edge in the rapidly changing financial landscape.