Digital and AI-powered Underwriting in Insurance Sector

According to Accenture’s recent article, “The entire insurance industry—its customer expectations, products, competitors, distribution channels, analytics, and data technology—is evolving significantly and quickly. For carriers to compete and grow in this increasingly complex environment, underwriting will have to evolve, too. Carriers will have to do more than just familiarize themselves with digital tools; they need to transform into Digital Underwriters.”

The insurance industry is undergoing a major transformation when it comes to digital underwriting. It is the primary errand of insurers, the principles on which the entire insurance business model endures. It helps in retrieving the applications for insurance and in deciding who will get cover and what the terms of that cover will be.

Underwriting has always been considered as one of the complex aspects of the insurance sector. Underwriting processes have always been lengthy, elaborate, and invasive leading to being viewed as an obstacle to customer reach and applicants acceptance.

As a result, there has been a constant demand to make insurance easy to buy, with a focus on improved customer experience. Traditional underwriting methods to select risks are useful however the process is time-consuming and involves high costs. The new and improved underwriting process streamlines the entire flow by including new data sources and dynamically analyzing them thereby reducing the invasiveness of risk management and in a holistic way improving the risk selection and policy values.

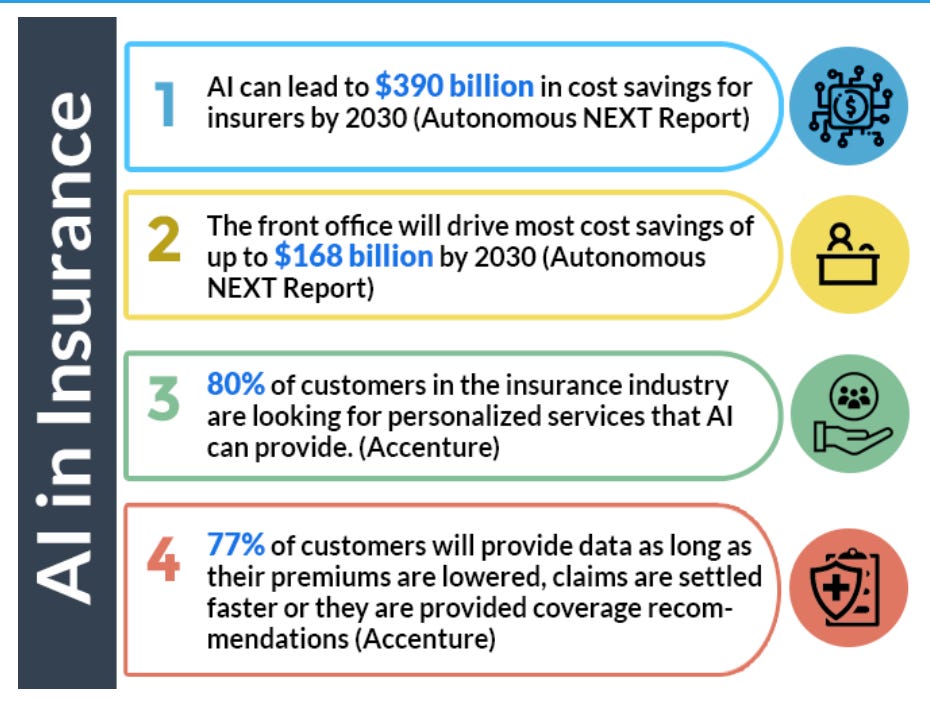

By leveraging disruptive technology like Artificial Intelligence, analytics, and alternate risk engines, connected through well-developed APIs, Intelligent underwriting algorithms can analyze information to build customer profiles and uncover risks more easily.

Let’s have a look at few uses of AI for risk anatomy:

Ability to capture real-time customer data (wearables data, environmental data, govt, social media, etc.) by performing risk assessment on both historical and real-time data.

Ability to perform picture analysis to estimate smoking, gender, BMI, and other information for better risk scoring.

Ability to provide automated verification of all data points, documents extraction (printed, medical, finance, handwritten, etc.), signature along with compliance reporting.

Ability to improve claims management

Source: SIMPLESOLVE Inc.

In a nutshell, the idea of integrating technology into underwriting functions is to achieve efficiency and uniformity across the insurance sector. The efficient processes enable the Industry to improve their customer satisfaction. Transparent, simple, seamless processes and better-quality decisions increase customer satisfaction, be it the end customer or the insurance broker who influences their decision.

Artivatic’s product- AUSIS helps meet these industry demands by providing a Smart Underwriting Cloud that can connect or integrate with existing or 3rd party apps through APIs for the end-to-end processes.

AUSIS supports the business in:

Reducing TAT up to 90%

Enabling data intelligence up to 80%

Improving efficiency up to 60%

Reducing cost up to 45%

Reducing risk up to 30%

Personalizing risk profiling

Help in increasing STP-Straight-through processing & NSTP Non-Straight through processing issuance up to 20-25%

Automating onboarding process up to 90%

Increasing better customer experience up to 70%

Embedding insurance to connect to non-traditional sectors like travel, pharma, marketplace, eCommerce, etc.

If you are interested to know more or looking for a demo about AUSIS- Our Smart UW Platform, write to us at layak@artivatic.ai or visit our website at https://new.artivatic.ai/