Building Next-Gen Financial & Medical Underwriting & Onboarding Processes for Instant Policy Issuance with AA, ABDM & Indiastack

Enhancing STP issuance under 60 seconds for customers with personalised offers, and also reducing cost of customer acquisition, TAT, Fraud & Enhancing efficiency.

The insurance industry is undergoing a major transformation, driven by the rise of digital technologies. One of the most significant changes is the move towards instant policy issuance. This is made possible by the use of new technologies, such as account integration (AA), Ayushman Bharat Digital Mission (ABDM), Indiastack (Digilocker, UIDAI), and artificial intelligence (AI) and machine learning (ML).

Background for AA, ABDM, IndiaStack & AI/ML

The insurance industry is undergoing a significant transformation, driven by advancements in technology. The integration of Account Aggregator (AA), Ayushman Bharat Digital Mission (ABDM) by National Health Authority (NHA), and IndiaStack (Digilocker, UIDAI) along with the use of Artificial Intelligence/Machine Learning (AI/ML) and Generic AI (GenAI) is revolutionizing the underwriting process. This article will delve into how these technologies can be leveraged to build next-gen financial and medical underwriting processes for instant policy issuance for both life and health insurance.

Account Integration (AA)

Account integration (AA) is a process that allows insurers to access and share customer data from multiple sources, such as banks, credit bureaus, and healthcare providers. This data can be used to assess a customer's financial and medical risk, and to determine whether they are eligible for a policy and what the premium should be.

Ayushman Bharat Digital Mission (ABDM)

The Ayushman Bharat Digital Mission (ABDM) is a national health information exchange (HIE) that aims to create a single, interoperable platform for sharing healthcare data across India. This data can be used by insurers to assess a customer's medical risk, and to provide more personalized and accurate insurance products and services.

Indiastack (Digilocker, UIDAI)

Indiastack is a set of open APIs and standards that enable the secure and reliable exchange of data between different organizations. Digilocker is a digital locker service that allows users to store and share their personal documents, such as PAN cards, Aadhaar cards, and driving licenses. UIDAI is the Unique Identification Authority of India, which is responsible for issuing Aadhaar cards.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are powerful technologies that can be used to automate many of the tasks involved in underwriting. For example, AI can be used to analyze large amounts of data to identify patterns and trends that can be used to assess risk. ML can be used to develop models that can predict the likelihood of a customer making a claim.

The Current Landscape

Traditionally, the underwriting process has been time-consuming and labor-intensive, involving manual data collection, verification, and risk assessment. This not only leads to high operational costs but also results in longer turnaround times (TAT), affecting customer satisfaction and revenue.

The Future of Underwriting: A Process Flow

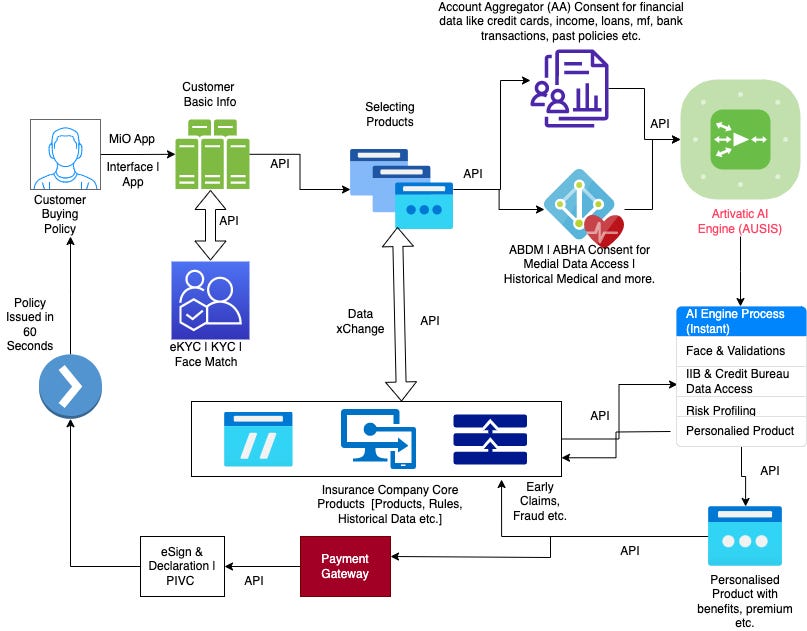

The integration of AA, ABDM, and IndiaStack, coupled with AI/ML and GenAI, can streamline the underwriting process, making it more efficient and customer-friendly. Here's a proposed process flow:

Data Collection: The customer provides consent to access their data through the AA framework. This data, which includes financial information from various sources, is then fetched in a structured and standardized format.

Data Verification: The data is verified using IndiaStack components like Digilocker (for document verification) and UIDAI (for identity verification).

Risk Assessment: The verified data is then processed using AI/ML algorithms to assess the risk profile of the customer. This includes analyzing medical history using data from ABDM.

Policy Issuance: Based on the risk assessment, a policy is instantly issued to the customer. GenAI can be used to provide personalized offers to the customer, enhancing their experience.

How Next-Gen Underwriting Can Benefit Insurance Companies

The integration of these technologies can bring about several benefits to the insurance industry. The use of next-gen underwriting can benefit insurance companies in a number of ways, including:

Cost Efficiency: Automation of data collection and verification can significantly reduce operational costs. Automating the underwriting process can help to reduce the costs associated with underwriting, such as the salaries of underwriters and the costs of processing paperwork.

Improved TAT: Instant data verification and risk assessment can drastically reduce the time taken to issue a policy. Next-gen underwriting can help to speed up the time it takes to issue a policy, which can make it more convenient for customers and can help to improve customer satisfaction.

Increased Revenue: By providing a seamless and personalized experience, insurers can attract more customers, leading to increased revenue. Next-gen underwriting can help insurance companies to reach a wider range of customers and to offer more personalized products and services, which can lead to increased revenue.

Risk Management: AI/ML algorithms can provide more accurate risk assessments, helping insurers manage their risk better.

Improved accuracy: AI and ML can help to improve the accuracy of underwriting decisions, which can reduce the risk of losses for insurance companies.

How Next-Gen Underwriting & Onboarding Can Benefit Direct Customers

Customers stand to gain significantly from this transformation. Direct customers can also benefit from next-gen underwriting in a number of ways, including:

Personalized Offers: With GenAI, customers can receive offers that are tailored to their needs and preferences.

Transparency: The use of AA, ABDM, and IndiaStack ensures that the process is transparent and the customer's data is secure.

Convenience: Next-gen underwriting can make it more convenient for customers to apply for and receive a policy.

Speed: Next-gen underwriting can help to speed up the time it takes to issue a policy, which can save customers time and money.

Personalization: Next-gen underwriting can help insurance companies to offer more personalized products and services, which can meet the specific needs of customers.

Accuracy: Next-gen underwriting can help to ensure that customers are offered the right type of coverage at the right price.

The integration of AA, ABDM, and IndiaStack, along with the use of AI/ML and GenAI, can revolutionize the customer onboarding & underwriting process, benefiting both the insurance industry and its customers. As technology continues to evolve, it's crucial for insurers to embrace these advancements and build next-gen underwriting processes.

Insights and Data

Let's delve deeper into the benefits of integrating AA, ABDM, and IndiaStack with AI/ML and GenAI in the underwriting & onboarding process with some data-driven insights.

Cost Efficiency

The automation of data collection and verification can significantly reduce operational costs. According to a study by McKinsey, automation can reduce the cost of a claims journey by as much as 30%. The significant reduction in costs is evident, highlighting the cost efficiency of this integration.

Improved Turnaround Time (TAT)

The use of these technologies can drastically reduce the time taken to issue a policy. According to a report by Deloitte, digital underwriting can reduce the policy issuance time from several days to just a few minutes. The reduction in TAT is significant, demonstrating the efficiency of this integration.

Increased Revenue

By providing a seamless and personalized experience, insurers can attract more customers, leading to increased revenue. A study by Accenture found that personalization can lead to a revenue uplift of up to 15%. The increase in revenue is substantial, underscoring the revenue potential of this integration.

Risk Management

AI/ML algorithms can provide more accurate risk assessments, helping insurers manage their risk better. According to a report by PwC, AI can reduce underwriting risk by as much as 20%. The reduction in risk is significant, highlighting the risk management capabilities of this integration.

Examples of Next-Gen Underwriting & Onboarding Processes

Here are some examples of next-gen underwriting processes that are being used by insurance companies today:

Aditya Birla Sunlife Insurance(ABSLI): ABSLI uses a combination of AI and ML to assess the risk of customers who apply for life insurance policies. This has helped the company to reduce the time it takes to issue policies by 50%, reducing their risk by 10%, enhancing operations efficiency by 40% and more.

Canara HSBC Life Insurance (CHLI): CHLI uses AI/ML/Video KYC /PIVC to provide quote, BI and instant policy issuance.

Next-gen underwriting & onboarding process, is a powerful tool that can help insurance companies to improve their efficiency, reduce their costs, and increase their revenue. It can also benefit direct customers by making it more convenient, faster, and more personalized to apply for and receive a policy. As the insurance industry continues to evolve, next-gen underwriting is likely to become even more important in the years to come. In conclusion, the integration of AA, ABDM, and IndiaStack, along with the use of AI/ML and GenAI, can bring about significant benefits to the insurance industry. The data-driven insights presented above provide a compelling case for the adoption of these technologies in the underwriting process.