Benefits of AI in Insurance Sales

According to Accenture, as many as 79% of insurance executives believe that AI will transform the way their companies communicate with customers.

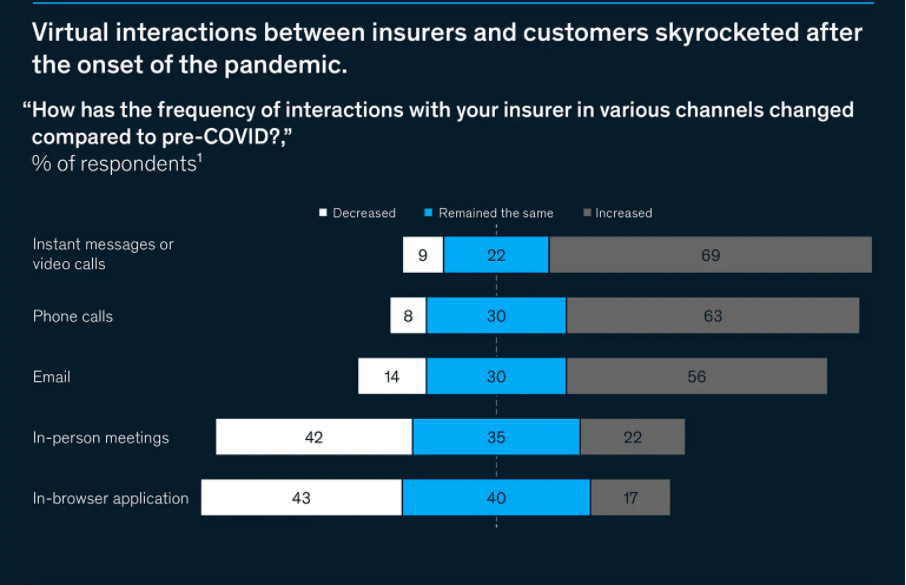

After the Covid-19 pandemic, the insurance sales and distribution segment have undergone a massive change. Many modern insurance buyers have started to research online. This has also increased competition in the insurance market that resulted in insurance companies pouring heavy investment in Insurtech industries.

Emerging technology like Artificial Intelligence plays an important role here. Among various industries, the insurance industry is also the one that has benefited from AI Automation. Artificial Intelligence serves as the perfect automated insurance assistant to provide next-gen digital sales, branch operations, and customer lead conversion solutions end to end.

The sales team are increasingly deploying Artificial Intelligence and predictive analytics to maximize revenue by recommending upsell and cross-sell opportunities to customer based on thousands of data points from demographic profiles, claims experience, fitness scores from wearables, and more. Moreover, other trends include robot advisers that can help sell new policies with little or no human intervention.

In insurance sales, AI capabilities add value and transform every individual in the overall value chain process.

AI helps in identifying the details of agents and their customers

It aids in providing automated lead scoring and AI-Based conversion for higher ROI

It helps in identifying and recommending the process for the next-best-action items that have to be taken care of.

It provides a video/audio-based communication system

It helps in delivering a win-win experience for both agent and the customers.

Basis the pointers mentioned above, there are areas where AI intervention transforms sales and distribution in the insurance industry.

Increasing conversion for leads using AI-based decision systems

Behavioral profiling improving sales engagement

Dynamic, personalized, and fully digital process and systems

Lead analysis, lead profiling, lead scoring, data enrichment

Automated capturing, filtering, segmentation, analyzing, and prospecting

Saving money for operations cost

Increasing ROI & Revenue for new business

Technological advancement is reshaping the insurance sectors from the inside out and the effects are observed mainly in operations. The moment insurance sales company amalgamate human ingenuity with Artificial Intelligence, can improve their sales and distribution. Insurance sectors are reaching out to insurtech companies that provide innovative tools, journey processes, technologies that make the life of salespeople as well as customers personalized and smooth.

Artivatic’s MiO Platform provides next-gen digital sales, branch operations, and customer lead conversion solutions end to end. MiO is a multi-dimensional unified platform for sales, marketing, agent, customer, branch, communication, and lead management.

MiO Sales allows a platform for insurance companies for unique, dynamic, and AI-based sales engines.

Some critical benefits businesses can have using MiO Sales system:

Reducing TAT up to 45%

Automated capturing, filtering, segmentation, analysis, and prospecting up to 60%

Lead analysis, lead profiling, lead scoring, data enrichment up to 80%

Increasing conversion for leads up to 65% using AI-based decision systems

Behavioral profiling improves sales engagement by up to 30%

Dynamic, personalized, and fully digital process, systems

No need for physical operations meet, branch/office

In the coming years, the operation segment in the insurance industry will be transformed on a larger scale which will demand organizations to reshape themselves to make most of the technology tools. It will allow them to operate more efficiently and with a greater focus on customer experience.

MiO Demo: Click here for MiO Sales Demo [Write to contact@artivatic.ai for Demo]

Read more about Artivatic’s other Products for insurance transformation: www.artivatic.ai