Artivatic Launches INFRD - API Insurance Cloud Platform to Build Future of Insurance

Modernizing API Infrastructure for Insurance. Insurance & Healthcare APIs for all your needs. 400+ APIs Available for building next-gen insurtech.

Insurance industry is witnessing high growth on distribution as more and more people are buying insurance, businesses are selling embedded insurance BUT?

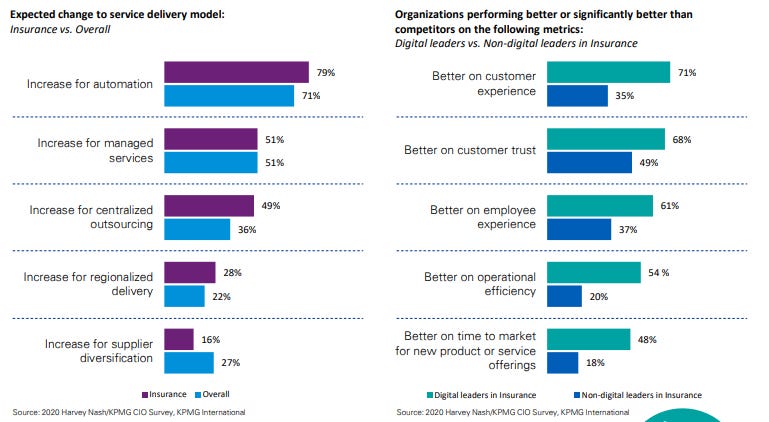

Is the existing insurance infrastructure scalable? connected? API driven? - Answer is NO. As per survey done by KPMG for insurance transformation, states that >45% CIOs wants to have digital transformation.

Insurance industry needs re-thinking towards their business & process transformation using new age technologies. >79% People said to have increase in automation.

Automation increase happens via APIs infrastructure. Insurance & Healthcare industry need to rethink their technology integration to Improve:

Operational Processes

Data Driven Focus

Customer Experience

Reducing Risk & fraud

Turnaround Time

Digital Journeys

Product Design

Claims Processes

Health Ecosystem

Cost & Efficiency

and More

ARTIVATIC Launches INFRD - Insurance APIs Cloud Platform (Beta Version)

To Enhance the same and change the way Insurance & Healthcare Industry Operates, Artivatic is launching first of its kind AI Insurance Cloud APIs Platform, called ‘INFRD’.

INFRD is an Insurance & Healthcare APIs Cloud Platform for all your needs. Embed Our Insurance/Healthcare Services into your products using our modular building block APIs for on-boarding, claims, risk, fraud, underwriting, KYC, Sales, Services, Hospital and more.

We have launched BETA VERSION of INFRD Insurance APIs Cloud Platform today with 15 APIs. We will be launching more than 400+ APIs by Mid July 2021.

What you expect from INFRD in BETA VERSION:

KYC APIs

Social & Digital APIs

Masking APIs

Financial APIs

Self Signing - API SaaS Platform for Every Insurance, Finance Developer & Businesses

Setup your own APIs

Use & Pay as per need

Check API Usages

API Documentation

Future Forward for INFRD 2.0 - In Jul 2021:

Underwriting APIs

Alternative APIs

Risk & Fraud APIs

Claims APIs

Speech, Video APIs

SME UW APIs

Health Risk APIs

Health UW APIs

Environmental APIs

Device APIs

Non-Invasive Health APIs

Property & Motor Insurance APIs

Product Design APIs

Distribution APIs

Sales APIs

Marketing APIs

Handwritten OCR/ICR APIs’

Govt & credit bureau APIs

IndiaStack APIs

Journey & Embedded Insurance APIs for health, Life

Telematics APIs

More than 400+ APIs you can expect in coming months

Signup Now to Test BETA VERSION of INFRD - Insurance & Healthcare APIs Cloud Platform: SIGN UP HERE.

Need a demo of INFRD, write to apisupport@artivatic.ai

To Know more About Artivatic: Click Here

About Artivatic: Artivatic is a global risk & decision-making platform that

automates human decisions in insurance & healthcare to provide efficiency,

transparency, risk assessment, personalization and digitization in entire

lifecycle of operations.

Artivatic has launched many platforms in recent past to empower Insuretch to drive future of insurance:

AUSIS: AI Smart Underwriting [Life, Health, SME, Alternative]

MiO: AI Sales & Marketing Platform

Onboarding: Onboard customers faster & seamless way

ASPIRE SME : Personalized Employee Health & Business Insurance

ASPIRE Customer: Self & Personalized Platform for policy manage, claims, family, health, mental health and communities

DARVIN: AI Healthcare Platform

ProdX Design: Product & Rules Design Platform

ProdX Distribution: API Driven Distribution for B2B2C

ALFRED: AI Claims Platform [ Accidental, Death/Disability, Health]

Looking forward to building the Operating System of Insurance!