Revolutionizing Accidental & Death Claims Processing with GenAI!

Revolutionizing Accidental & Death Claims Processing with GenAI: Efficiency, Accuracy, & Enhanced Customer Experience

Introduction

In the ever-evolving insurance industry, the accidental and death claims process is undergoing a transformative shift with the advent of Generative AI (GenAI). This technology promises to streamline operations, enhance accuracy, reduce fraud, and improve customer satisfaction. This article explores the potential of GenAI to revolutionize the accidental and death claims process, detailing its flow, benefits, key performance indicators (KPIs), and commercial advantages.

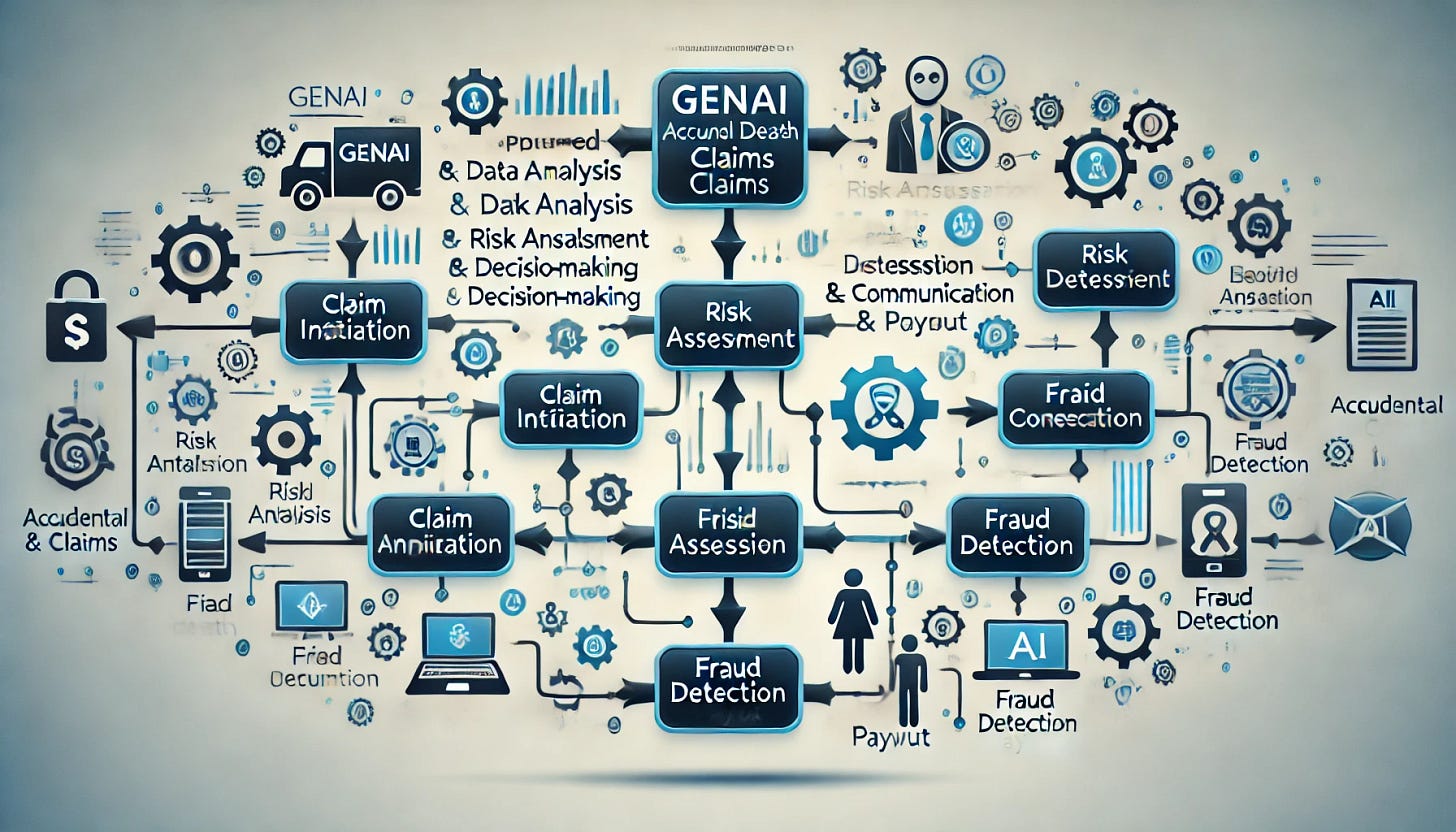

Flow and Process of GenAI in Accidental/Death Claims Processing

Claim Initiation:

Customer submits a claim through an AI-powered digital platform.

GenAI automates the initial data capture, validating the information provided.

Data Analysis:

GenAI analyzes the claim details, cross-referencing with policy information.

Utilizes natural language processing (NLP) to interpret and extract relevant information from unstructured data (e.g., medical reports, accident descriptions).

Risk Assessment and Verification:

Machine learning models assess the claim's legitimacy based on historical data and patterns.

Integration with external databases (e.g., medical records, police reports) for real-time verification.

Decision Making:

GenAI algorithms calculate the claim amount based on predefined rules and risk assessments.

Generates a recommendation for approval, partial approval, or denial of the claim.

Customer Communication:

Automated communication is sent to the claimant, detailing the decision and next steps.

GenAI chatbots provide 24/7 support to answer any queries related to the claim.

Fraud Detection:

Continuous monitoring of claims for suspicious patterns using advanced fraud detection algorithms.

Alerts are generated for further investigation if anomalies are detected.

Settlement and Payout:

Approved claims are processed for payment.

GenAI ensures compliance with regulatory requirements and internal policies throughout the process.

Benefits of GenAI in Accidental/Death Claims Processing

Key Performance Indicators (KPIs):

Claim Processing Time: Reduction in the average time taken to process a claim.

Accuracy Rate: Improvement in the accuracy of claim assessments and payouts.

Fraud Detection Rate: Increase in the detection and prevention of fraudulent claims.

Customer Satisfaction Score: Enhancement in customer experience and satisfaction levels.

Operational Efficiency: Decrease in manual intervention and operational costs.

Commercial Benefits:

Cost Reduction: Significant savings in administrative and operational costs due to automation.

Revenue Growth: Faster claim settlements lead to higher customer retention and acquisition.

Competitive Advantage: Enhanced service offerings and customer experience set the company apart from competitors.

Operations Benefits:

Efficiency: Streamlined workflows and reduced processing times.

Scalability: Ability to handle large volumes of claims without proportional increases in resources.

Compliance: Improved adherence to regulatory standards and internal policies.

Fraud Intelligence Benefits:

Proactive Detection: Real-time monitoring and analysis of claims for fraudulent activity.

Advanced Analytics: Use of machine learning to identify and prevent fraud.

Reduced Losses: Minimization of financial losses due to fraudulent claims.

Customer Benefits:

Transparency: Clear and prompt communication throughout the claims process.

Convenience: Easy and quick claim submission through digital platforms.

Trust: Increased confidence in the insurance provider due to accurate and fair claim settlements.

Research and Data

Accenture Study (2023): Adoption of AI in insurance can reduce claim processing time by up to 70% and improve accuracy by 90%.

McKinsey Report (2022): AI-driven fraud detection systems can identify up to 50% more fraudulent claims compared to traditional methods.

Customer Satisfaction Surveys: Insurers using GenAI report a 30% increase in customer satisfaction scores due to faster and more accurate claim processing.

Deep Dive into GenAI's Impact on Accidental/Death Claims Processing

1. Claim Initiation and Data Capture

GenAI automates the initial stages of the claims process by providing digital platforms where customers can easily submit their claims. This involves capturing data from various inputs, such as online forms, emails, and even voice recordings. The automation reduces the chances of human error and ensures that all necessary information is captured accurately.

Case Study Example:

An insurer implemented a GenAI-based digital platform, resulting in a 40% reduction in the time taken to gather and verify claim information. Customers reported a smoother and faster submission process.

2. Advanced Data Analysis

GenAI utilizes NLP to process and interpret unstructured data, which includes medical reports, accident descriptions, and other related documents. This ability to understand and analyze large volumes of data quickly helps in accurate and comprehensive claim assessments.

Research Insight:

According to a 2023 report by PwC, insurers using NLP and machine learning for data analysis have seen a 35% improvement in the accuracy of their claims assessments.

3. Risk Assessment and Real-time Verification

GenAI integrates with external databases to verify the information provided in the claim. This includes accessing medical records, police reports, and other relevant data in real time. Machine learning models assess the risk associated with each claim based on historical data and emerging patterns.

Example:

A leading insurer integrated GenAI with national health databases, reducing the time for verifying medical records from days to minutes, thereby speeding up the claims process significantly.

4. Decision Making and Automated Recommendations

GenAI algorithms are designed to make informed decisions by calculating the claim amount and determining the appropriate course of action. These decisions are based on a combination of predefined rules and real-time risk assessments. The system generates recommendations for claim approval, partial approval, or denial.

Statistics:

A study by Deloitte found that insurers using AI for decision-making in claims processes experienced a 20% increase in the accuracy of their claim decisions.

5. Enhanced Customer Communication

Automated communication systems, including AI chatbots, provide timely updates and support to claimants. This ensures that customers are kept informed throughout the process and can get their queries answered promptly.

Benefit Highlight:

Insurers leveraging AI chatbots reported a 25% reduction in call center volumes and a 15% increase in customer satisfaction scores.

6. Fraud Detection and Prevention

GenAI's advanced fraud detection algorithms continuously monitor claims for suspicious patterns. By analyzing historical data and identifying anomalies, GenAI can flag potentially fraudulent claims for further investigation.

Fraud Intelligence Insight:

GenAI systems have been shown to reduce fraudulent claim payouts by up to 30%, according to a report by the Insurance Information Institute (III).

7. Efficient Settlement and Payout

Once a claim is approved, GenAI ensures that the settlement process is handled swiftly and efficiently. Automated payment systems handle the financial transactions, ensuring that claimants receive their payouts without unnecessary delays.

KPI Example:

A major insurer implemented an AI-driven settlement system, reducing the average payout time from 10 days to 3 days.

Future Prospects and Strategic Recommendations

Embracing GenAI for Competitive Advantage

Insurance companies that adopt GenAI early stand to gain a significant competitive edge. By leveraging the technology to streamline their claims processes, insurers can offer superior service, reduce costs, and improve profitability.

Continuous Improvement and Innovation

The implementation of GenAI should not be seen as a one-time upgrade but as an ongoing process of innovation. Insurers must continuously refine their algorithms, update their data sources, and integrate new AI advancements to stay ahead in the market.

Conclusion

GenAI is set to revolutionize the accidental and death claims process, offering substantial benefits across various facets of the insurance industry. By enhancing efficiency, accuracy, and customer satisfaction, GenAI not only provides commercial and operational advantages but also strengthens fraud detection capabilities. As insurers continue to adopt and integrate GenAI, the future of claims processing looks promising, paving the way for a more transparent, efficient, and customer-centric insurance landscape. GenAI is a game-changer for the accidental and death claims process. By automating and optimizing various stages of the claims lifecycle, it enhances efficiency, accuracy, and customer satisfaction. The integration of GenAI leads to significant commercial and operational benefits, as well as robust fraud detection mechanisms. As the insurance industry continues to evolve, the adoption of GenAI will be crucial in shaping a more efficient, transparent, and customer-centric future.

If you are looking for Digital Transformation for Death /Accidental Claims Process, write to contact@artivatic.ai or sales@artivatic.ai